Enterprise leaders can no longer treat services and software as distinct buying categories. Earlier this year, HFS sized the Software-as-Services (SaS) market as a $1.5 trillion opportunity. This convergence, where services are being codified as software and software is absorbing services, is triggering a collision between traditional service providers and software firms. Both are racing to embed intelligence, codify IP, and take ownership of business outcomes through scalable, subscription-led models.

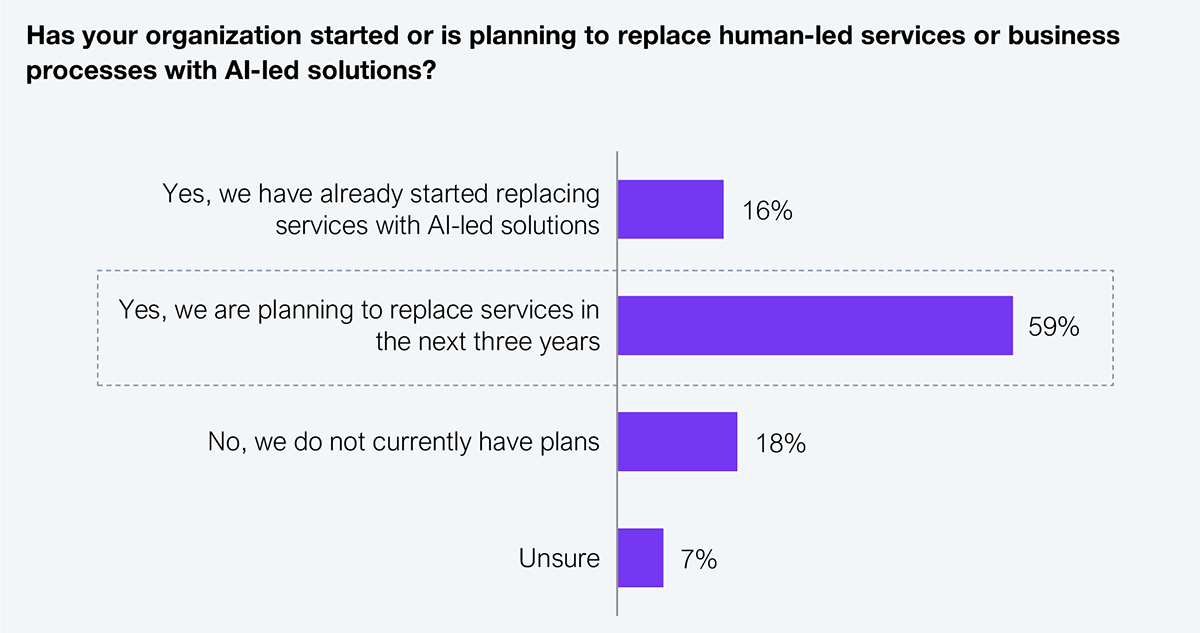

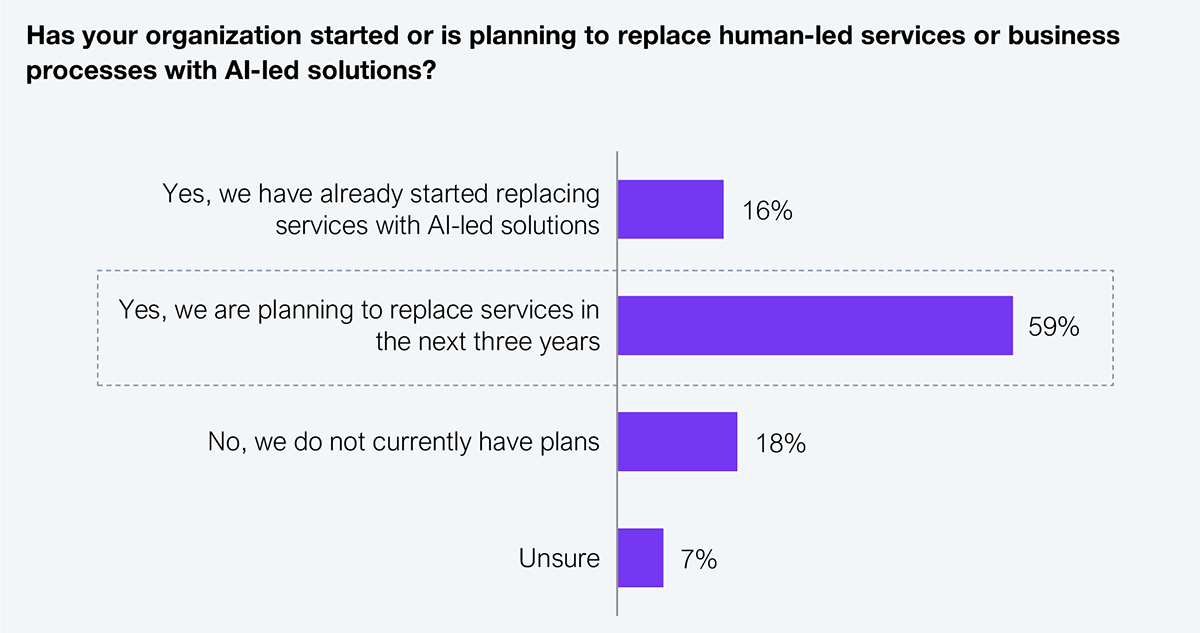

Enterprises increasingly view SaS as a future-proof model. Two-thirds plan to replace significant human-led services and processes with AI-led solutions within the next three years. This shift is fueled by the urgency for agility, resilience, and speed amid volatile macro conditions and rapid tech advancement.

Exhibit 1: The HFS 2030 vision of SaS just got fast-tracked by at least two years

Sample: 305 major enterprise decision makers

Source: HFS Research Pulse, 2025

SaS is already starting to find its feet in the enterprise world:

- Siemens Energy is embedding AI into manufacturing lines to codify quality control and detect defects in real time.

- General Motors is standardizing supplier data exchange through a shared platform that orchestrates collaboration across its supply chain.

- Standard Chartered is replacing periodic audits with continuous, AI-driven risk scoring to manage third-party exposure.

- Amazon is operationalizing AI across its logistics network to dynamically manage inventory, forecast demand, and optimize fulfillment with minimal human input.

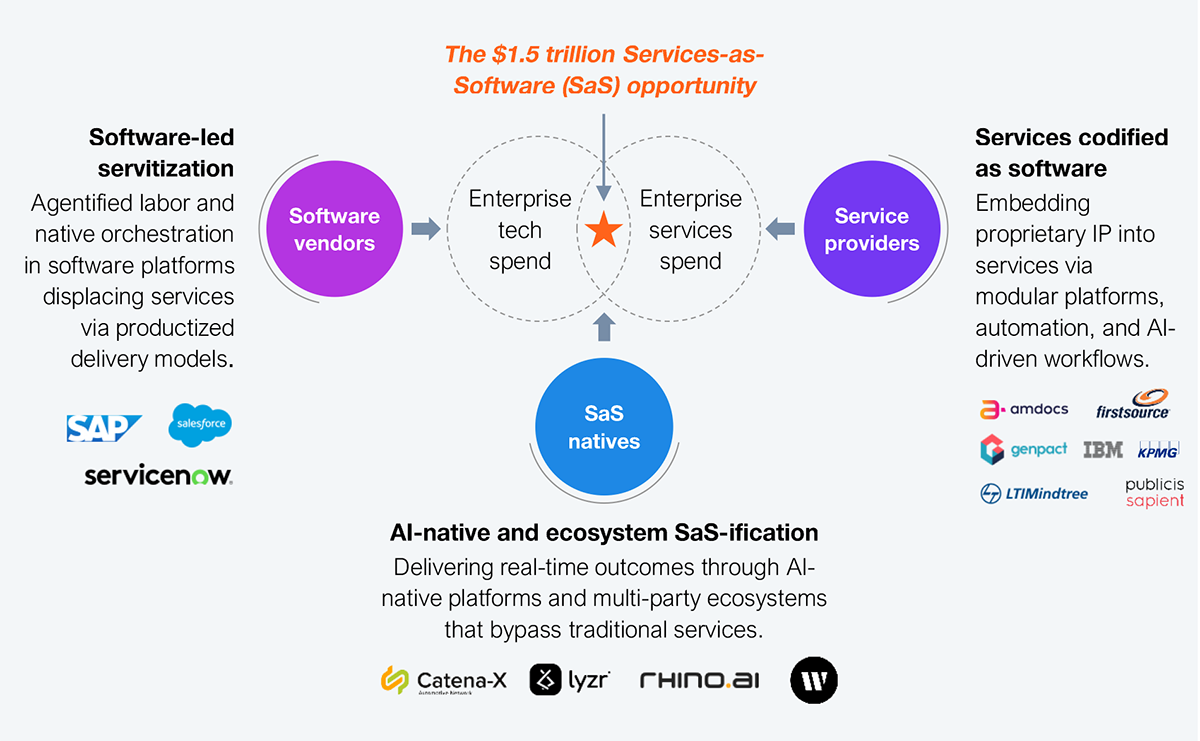

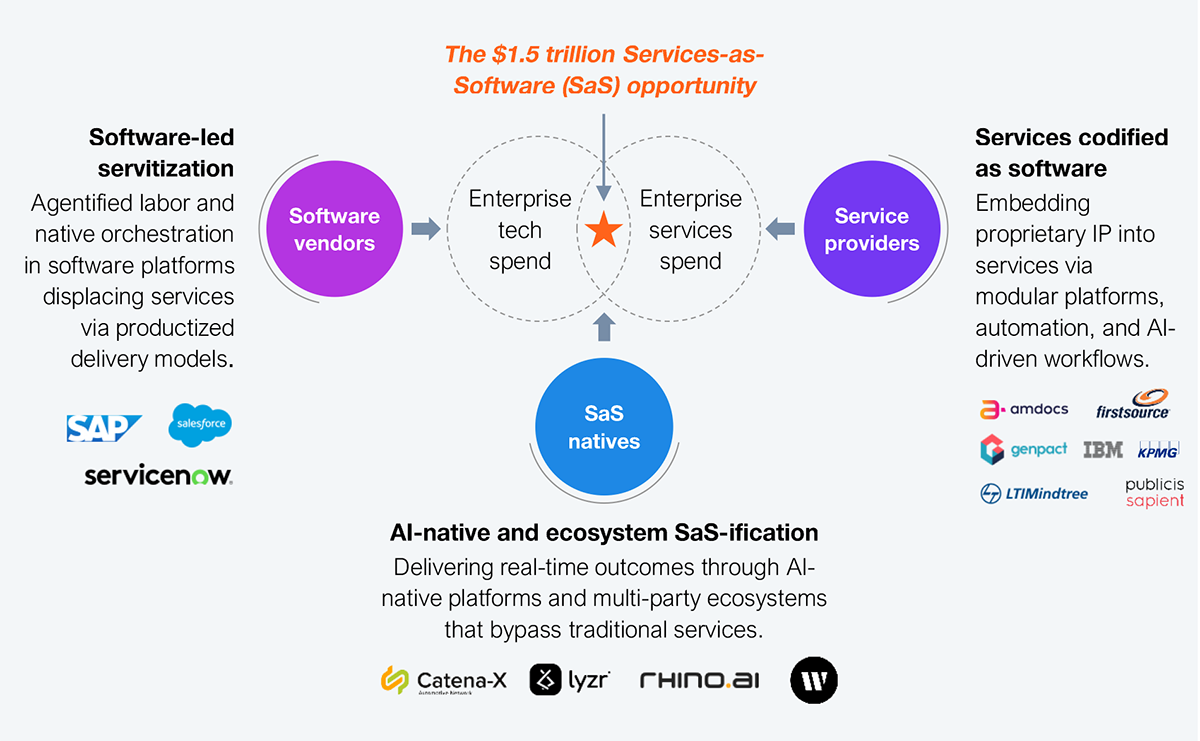

The three paths to SaS—and why they matter for enterprise leaders

The maturation of cloud-native AI, telemetry-rich platforms, and scalable IP codification is accelerating SaS adoption across three emerging pathways.

Exhibit 2: The emerging SaS ecosystem of the future

Source: HFS’ analysis of the evolving SaS market, 2025

1. Services codified as software

Traditional services in areas such as finance, ERP support, and IT operations are being broken down into repeatable workflows, bots, and AI agents. Providers are transforming delivery into modular, platform-enabled, subscription-based offerings.

Enterprise leaders must demand more than automation. They should look for platform-enabled services with observable performance, modular pricing, and continuous delivery upgrades.

Buyer lens on providers:

- IBM (Advantage) claims to modularize delivery with reusable IP and automation. Press them for outcome-level guarantees, not slideware.

- KPMG Workbench is an open, Microsoft-Azure-based, multi-agent AI platform that orchestrates dozens of interoperable, model-agnostic assistants to automate and speed up complex client-delivery tasks. Enterprises should ask how seamlessly it can plug into their own data, models, and compliance framework to create secure, measurable value.

- Amdocs Studios is helping enterprises modernize, launch new experiences, and drive measurable business outcomes. Clients should ask it to build tailored transformation roadmaps such as cloud migration, GenAI-enabled QA, and next-gen customer experience design.

- Genpact’s Service-as-Agentic-Solutions provisions industry-trained AI agents that autonomously support business operations with personalization, scalability, and built-in governance. How will these agents be tailored to workflows and evolve with the business while ensuring transparency and control?

- Firstsource’s UnBPO is promoting a digital-first framework. Enterprise buyers must ask how this platform reduces decision latency, not just FTE count.

- LTIMindtree’s Blueverse offers an AI-first ecosystem with interoperable accelerators for business-aligned transformation. Clients should challenge how its modular “Studios” and “Mosaics” will deliver sustained value beyond pilot automation.

- Publicis Sapient via its Slingshot is attempting to productize consulting IP through a low-code platform. But where’s the enterprise proof? Demand it.

- Microland (Intelligeni) converts IT operations into AI-driven managed services using telemetry and automation.

- Ascendion AVA blends GenAI and engineering automation to fast-track software product development and talent augmentation. Push for proof of how it accelerates real-world build cycles and quality outcomes, not just resume speed.

- Other players such as Quinnox (application management), Humanize (SaaS platform implementation, migration and maintenance), Atomicwork (AI-native ITSM automation), and Xurrent (cloud-native service orchestration) are also building SaS-aligned platforms in focused domains.

2. Software-led servitization

In this category, established SaaS platforms embed orchestration, automation, and AI into core products to absorb service functions. The goal is to deliver packaged modules that not only enable extensibility but also produce KPIs as a productized outcome. This approach increasingly displaces external service providers by delivering embedded services.

This is where software cannibalizes services. Enterprise leaders must evaluate SaaS platforms not just on features but on their ability to replace legacy services with embedded execution.

What to watch out for:

- ServiceNow Pro+ automates ITSM. But does it replace your help desk or just reduce tickets?

- SAP Joule injects AI into ERP. But can it deliver audit-ready, real-time insights without human curation?

- Snowflake Cortex, Salesforce Einstein, Veeva, nCino are packaging services as productized modules. Hold vendors accountable to outcomes, not subscription usage.

3. AI-native and ecosystem SaS-ification

A new wave of platforms is bypassing traditional service delivery to deliver real-time, adaptive business outcomes. These offerings are AI-native, cloud-first, and designed for autonomous decision-making, continuous optimization, and contextual recommendations.

AI-native examples include:

- Lyzr.ai: Builds, deploys, and manages AI agents to automate and optimize business workflows.

- Writer: Provides an AI platform called ‘AI HQ’ that bridges the gap between business and IT by enabling collaborative creation, activation, and supervision of enterprise-grade AI agents.

- rhino.ai: Offers GenAI agents that extract business logic to create and transform applications, making them capable of running across any platform.

- Interos: Continuously scores supply chain risks using AI and graph analytics.

- Clari and Gong: Automate revenue forecasting and sales insights.

- Watershed and Persefoni: Automate ESG reporting and emissions tracking.

At the same time, ecosystem-scale platforms are emerging to facilitate collaboration, orchestration, and shared data environments across industries.

Examples of ecosystem platforms:

- Catena-X: Enables standardized collaboration across the automotive supply chain through real-time data sharing and compliance coordination.

- GSBN (Global Shipping Business Network): Facilitates secure, paperless trade across logistics players and terminal operators.

These platforms bypass legacy service models altogether. They deliver autonomous decision-making, continuous optimization, and cross-industry collaboration. By doing so, they are shifting the buying center away from both traditional services and legacy software vendors.

Enterprise value hinges on two words: Business outcomes

As the SaS market evolves, success will not be defined by automation alone. It will depend on a provider’s ability to link codified delivery to measurable business outcomes. Providers must go beyond delivering platforms or process automation and show tangible improvements in decision-making, transparency, and operational performance.

To lead this new model, providers must shift from task execution to demand shaping and outcome enablement. This includes making service performance observable, aligning operations with business KPIs, and embedding intelligence throughout delivery workflows.

Exhibit 3: The current SaS landscape is shaping well with a compelling value proposition for enterprises—but business impact would decide uptake

Source: HFS’ analysis of promising SaS offerings, 2025

For enterprises, codifying services is not the endgame. Embedding intelligence and receiving measurable business value is.

Enterprise leaders must:

- Shift from task-based SLAs to outcome-linked KPIs

- Demand observability in service performance, not anecdotal dashboards

- Embrace modular IP ownership and continuous telemetry as core procurement criteria

- Stop measuring inputs (FTEs, licenses) and start measuring decision speed, risk mitigation, and time-to-value

The Bottom Line: SAS is getting real, and it’s time to rewrite your operating model with embedded, intelligent, measurable engines for business growth.

Enterprise leaders must now lead the shift:

- From people-based delivery to IP-led execution

- From process outsourcing to outcome orchestration

- From annual renewals to continuous, telemetry-driven value realization

The $1.5 trillion SaS opportunity won’t be captured by those that cling to legacy contracts and comfort zones. Ultimately, SaS will require a new buying and selling playbook: one that rewrites the rules around pricing, governance, IP ownership, talent, and partnership structures.

At HFS, we are actively unpacking these shifts. Watch this space for deeper dives into the economics, architectures, and operating models that will define the future of SaS.