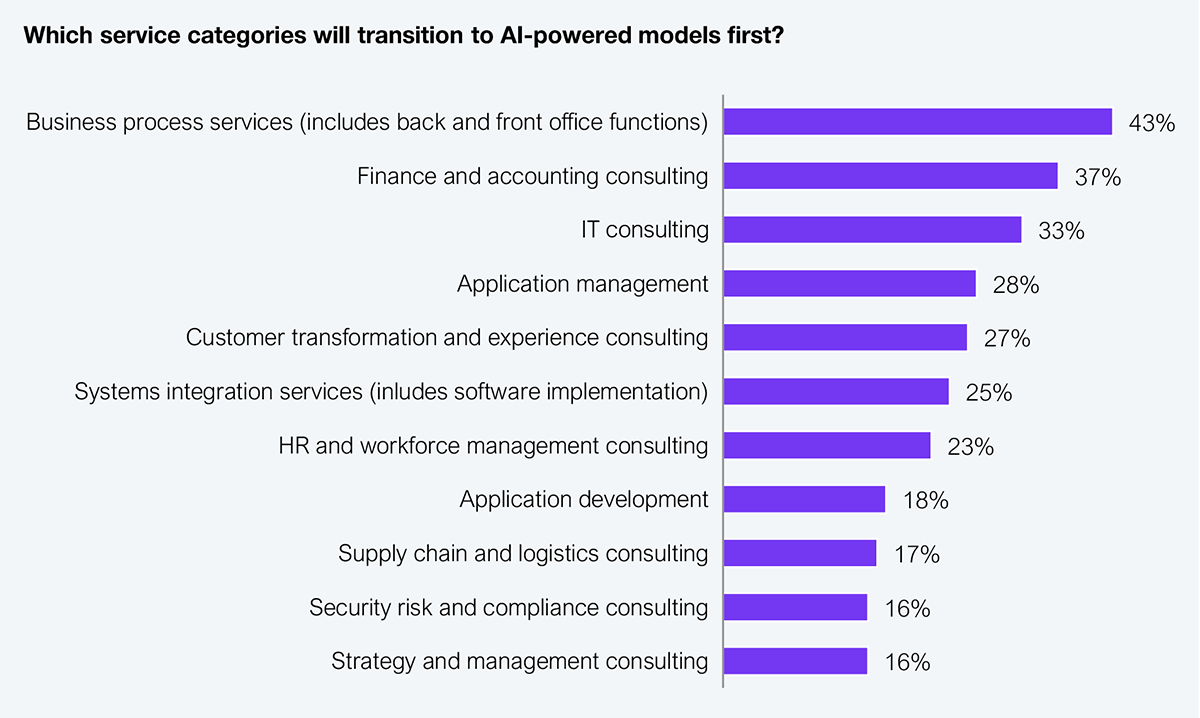

With AI automating most finance workflows in the next 18 months, CFOs still seeing finance as a back-office cost center are leading their enterprises toward obsolescence. Legacy delivery models, fragmented tech stacks, and risk-averse cultures have kept many stuck in that mindset

(see Exhibit 1).

To break out of that mould, finance must become a software-led, human-governed intelligence layer that delivers faster decisions, sharper foresight, and enterprise resilience.

Source: 1,002 enterprise leaders, HFS Research, 2025

Finance is at the centre of structure, scale, and strategic influence. It runs on clean, governed data, processing repeatable workflows fast and shaping the way enterprises allocate capital, measure performance, and respond to risk.

While other functions still struggle with unstructured data and ambiguous workflows, finance is ready for intelligence at scale, positioning it at the top of the AI adoption curve. However, the real story goes beyond automation; it’s about transformation.

The finance function is becoming an enterprise intelligence layer, and the stakes are measurable. Yet the same delivery model built for labor arbitrage, monthly close cycles, and linear workflows makes it hard to turn that AI readiness into real transformation. Moreover, manual reconciliations, spreadsheet-driven variance analysis, and sequential processes can’t keep pace with the AI-level speed.

By 2026, CFOs clinging to traditional delivery models will be operating at half the speed of their competitors while explaining to boards why finance has become a bottleneck. Unless they overhaul their delivery and operating models now, finance won’t deliver AI-induced outcomes and may become the biggest obstacle to scaling AI.

1. Services-as-SoftwareTM replaces labor with intelligence: Clients no longer want people pushing processes. They want outcomes delivered through intelligent platforms that self-correct, self-learn, and scale without worrying about the headcount. Finance is well suited for this shift. Every part of the F&A value chain, from record to report and order to cash to FP&A, can be delivered as modular, software-led services.

With Services-as Software, the value equation shifts from transactions processed to insights delivered, enabling better and faster decisions. The new model focuses on compounding intelligence, marking an end to linear finance.

2. Tariffs, localization, and AI sovereignty fragment global delivery: Finance operations built on offshore labor arbitrage are running into geopolitical decelerators. Tariffs, visa restrictions, data sovereignty laws, and AI-localization requirements are forcing CFOs to rethink their delivery architecture.

HSBC, for instance, has restructured its finance data architecture to comply with AI-sovereignty laws across China and the EU, adopting a federated model that balances local compliance with enterprise-wide visibility.

The next-generation model combines local compliance to meet regulatory requirements, global visibility to maintain enterprise control, and distributed AI that adapts by geography without compromising cohesion.

3. Human + machine redefines the finance workforce, not by replacing talent but by elevating it

As AI copilots take up tasks such as reconciliations, journal entries, variance analysis, and scenario modelling, finance professionals are shifting to higher-order roles, including AI supervisors, risk and trust architects, narrative storytellers, ethics custodians, and cross-functional strategists.

Microsoft’s AI-led finance team now closes 30% faster. Similarly, Unilever’s analysts spend more time shaping insights than reconciling data.

Traditional consulting sells time and expertise, while AI-powered consulting sells forecast accuracy, compliance assurance, working capital improvements, cycle time compression, and scenario intelligence.

As finance moves toward intelligent platforms, consulting firms will face a reckoning. Firms built on FTE pyramids will struggle, while those that productize their IP into reusable models, data assets, and autonomous financial services will lead.

Service partners will be defined by the IP and platforms they deliver, not by the volume of deployments. This shifts the selection mechanism toward those that can productize intelligence, not labor.

Internally, organizations must evolve from executing processes to governing the AI that executes them, with augmented roles focused on oversight, validation, and the broader narrative. The CFO budgeting model should follow suit, moving away from funding headcount toward funding predicted outcomes, accuracy, and measurable enterprise impact.

In an AI-native finance function, trust takes precedence over accuracy. Stakeholders will demand explainability, audit trails, and ethical safeguards. Humans provide judgment, while machines offer scale. Finance must orchestrate both.

CFOs must take deliberate steps to achieve this:

These actions create the operating blueprint for finance to become the enterprise AI engine.

Building intelligent, trusted, human-governed finance platforms will set the standard for how the AI-native enterprise runs. Staying in process mode would leave you explaining lost ground to faster, more innovative competitors.

Register now for immediate access of HFS' research, data and forward looking trends.

Get StartedIf you don't have an account, Register here |

Register now for immediate access of HFS' research, data and forward looking trends.

Get Started