If there’s one theme we’ve picked out from the IT Services research into infrastructure management and digital consulting, it’s the increasing importance of consultancy and professional services. This trend is part of a larger drift of provider engagement models moving away from a technology focus and toward one that understands and investigates a business problem before it designs and implements a solution. This nascent trend has already had an interesting effect on digital technology strategy and consultancy services, even though it’s rarely more than marketing narrative at this stage. We discuss these trends in more detail in the recently published Blueprint report, but some are so important and sweeping that we felt compelled to run through them in this PoV.

Consulting Never Dies – The Market Keeps on Growing

We need to start off with the fact that HfS data reveals stable growth in the IT professional services market across the globe, with a compound annual growth rate of 5.9% in North America and Western Europe, the industry’s two largest markets. In smaller markets such as Eastern Europe and Latin America, we can see higher estimated growth rates of up to 8.6% (see Exhibit 1). It’s clear that the consultancy market isn’t going anywhere. Compared to the infrastructure management market, which saw traditional revenues in freefall as businesses moved toward the as-a-service model, the consultancy space with its stable and reasonable growth rates seems calm. However, significant trends are at play that make the market far from easy money for service providers.

Exhibit 1: IT Professional Services Market by Region 2016-2021 ($B)

Source: HfS Research 2017. Based on estimate of the IT professional services revenues for the leading providers from publicly stated financial statements

The “It’s All About the Business” Broken Record Still Isn’t Fixed

It seems like we’ve been talking about focusing on business outcomes since records began, and we’re still not quite there yet. As we briefly mentioned, we’re witnessing a big push across the IT Services space to move away from a technical view of solutions, which has been the core engagement model of the provider community, and toward solutions that seek to understand a business challenge or desired outcome before designing a solution to solve it.

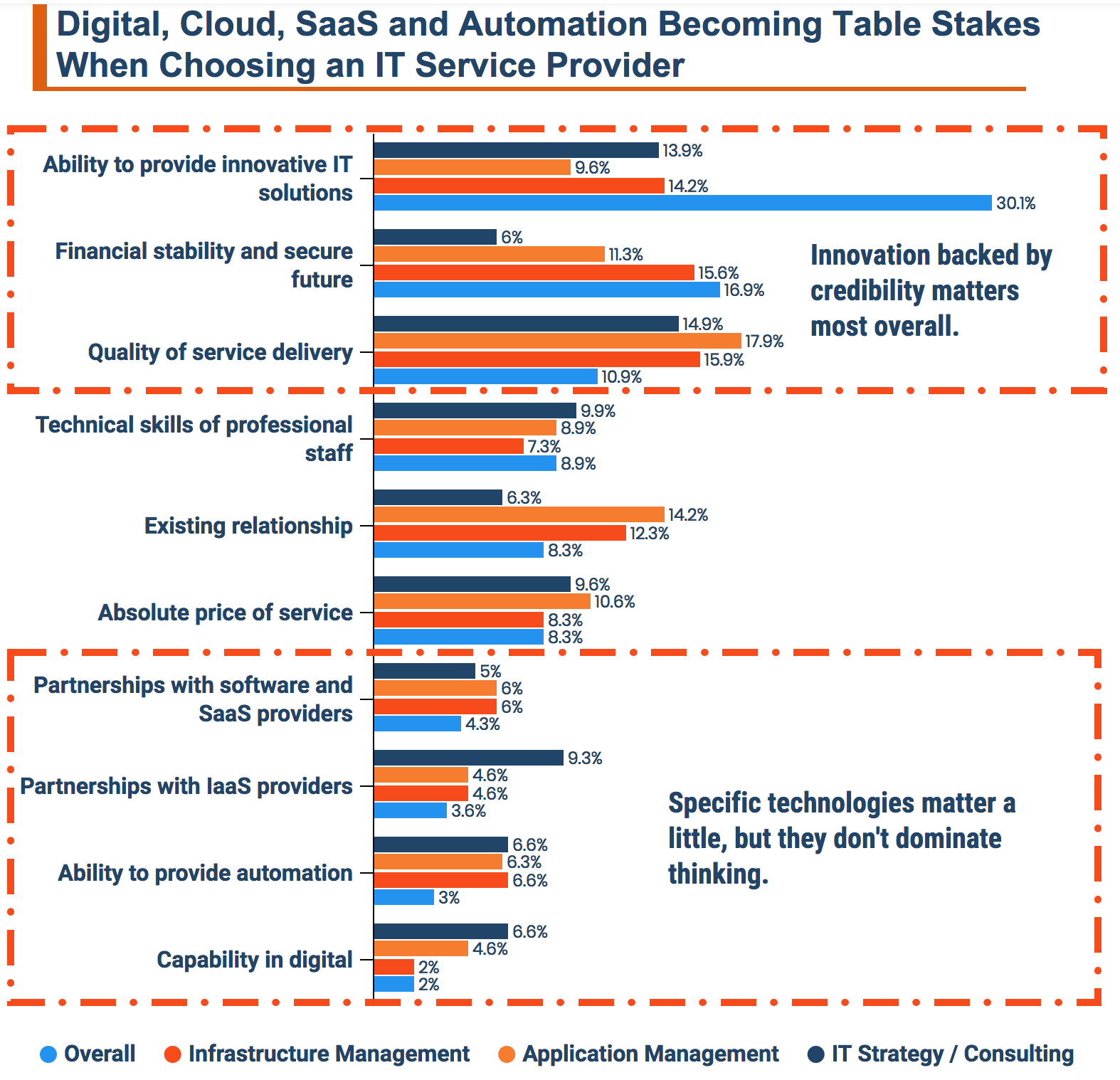

In Exhibit 2 we can see the selection criteria across IT Services and, in particular, for professional services engagements. We can see that overall, buyers are looking for innovation, financial stability, and quality of service. Consulting buyers care more about quality and skills (as well as innovation), while prior engagements and the familiarity they bring are much less important for consulting clients than in other IT areas. Crucially, buyers are starting to care less about the technology that drives the innovation – at least as dominant factors driving selection.

Crucially, the role technology plays in the modern business is undoubtedly greater than ever before, which makes this shift in priorities seem odd. However, as the use of business technologies grows, so does its direct impact on business outcomes – often shifting from the back-office to across the entire business. As a result, clients are more focused on the business challenges they need to solve, rather than specific technologies they would like to implement.

Exhibit 2: IT Services Buyer Selection Criteria

Source: HfS Research 2017, n=302 IT Services Clients

Some providers have taken this approach seriously and have recognized the need to bring on the talent necessary to dive into business challenges, understand them, and then build a custom solution. Some have even discussed scenarios in which they turned down deals where the problem to be solved wasn’t clear. For others, however, it’s tough to see past the smoke and mirrors of marketing rhetoric to reach a point where we can truly understand what’s changed with their approach.

What’s clear is that client demand is now driving the shift in engagement approaches. There are too many stories of clients getting their fingers burnt from badly designed solutions or poorly implemented technologies that fail to get to the root of the problem. Clients want a provider that understands them and their industry and has a track record of delivering services that get the job done.

|

A client reference from our Blueprint research lauded their firm’s ability to push beyond the technical and argued that their relationship evolved “from a technical service provider to a real partner, including bringing in new business ideas, reducing complexity – even at the expense of their business with our company.” |

So, now we know that professional IT services are increasing and clients are pushing for providers to expand outside of the traditional narrative. But what does this mean on the delivery side? Well, one thing’s for certain from our conversations with providers: They’re working harder to bring in the key talent they need to drive services forward.

The Fight for Talent Heats Up

If providers are to meet this shift in demand, they’ll need talent. A lot of it. In many ways, the fight to get the best and brightest consultancy talent is becoming the main battleground in the IT Services space. We’re seeing providers acquire key consultancy talent or partner with key academic institutions to gain access to pools of highly skilled graduates. This trend has certainly impacted clients, with some expressing dismay that either a lack of professional talent or high turnover has had a detrimental effect on their engagement.

|

One client relayed that the quick turnover of talent has severely impacted their ability to build relationships as “key staff are never around long enough for things to settle.” |

While the labor market is not at its breaking point yet, if all 21[1] of the large IT Services providers we studied start pushing recruitment efforts, it may be too much for some talent pools to handle. A recently published report by HfS[2] demonstrates the impact of this future challenge by highlighting that the same skills are in demand by both enterprises and providers, which could lead to an extended focus on particular skill and talent pools.

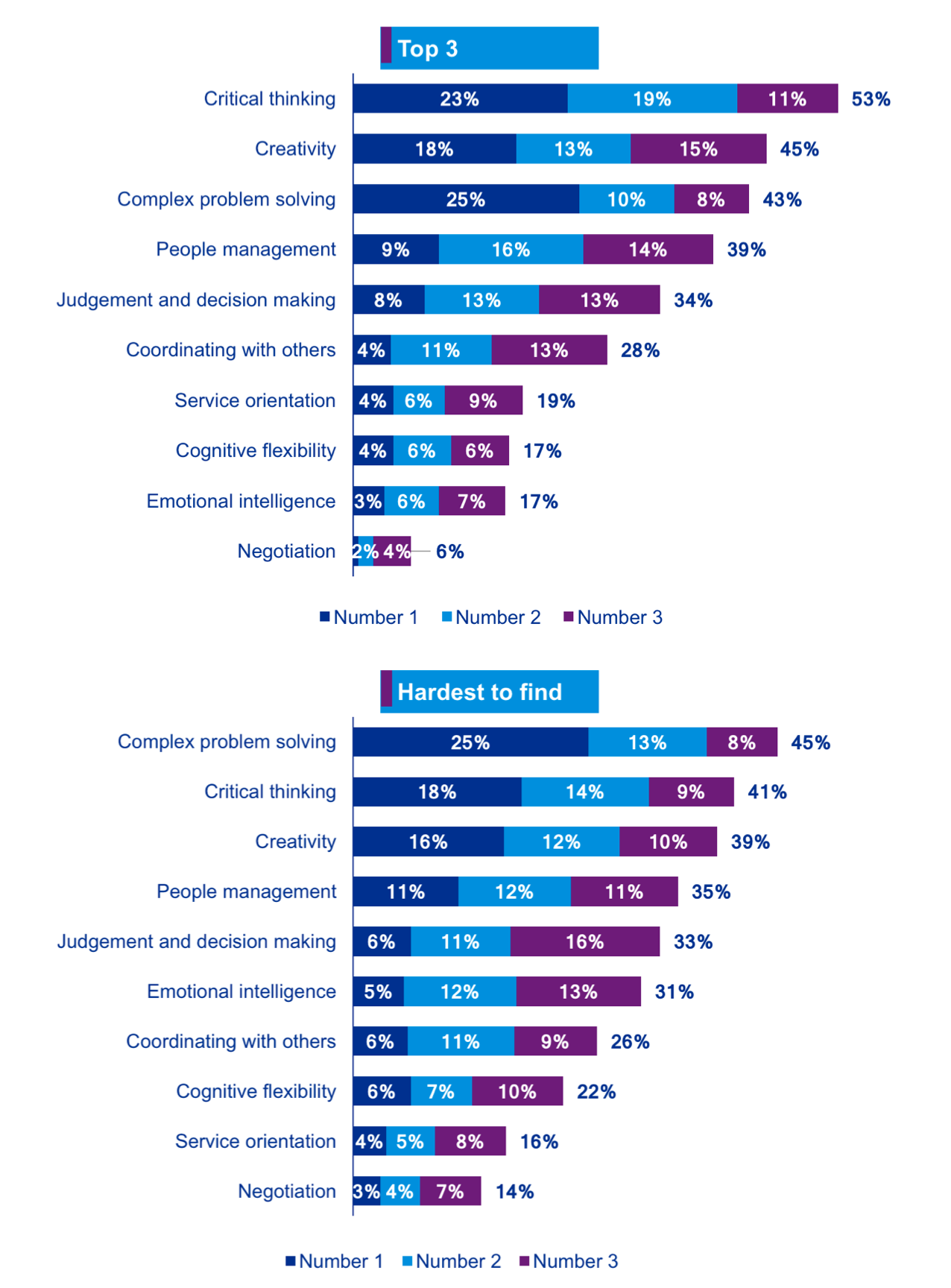

In Exhibit 3, we can see the skill sets that enterprises find the easiest and hardest to recruit, which demonstrates potential challenges. While the original report goes into more detail, at a glance we can see that the majority of enterprises are chasing the same skill sets, which eventually can place significant pressure onto talent pools.

Exhibit 3: Top Enterprise Skill Requirements and Those Hardest to Find

Source: HfS Research in conjunction with KPMG, State of Business Operations 2017 N=454 Enterprise Buyers

Traditional Firms Stake a Claim to the Digital Space

To focus our attention on a market force that has a different set of challenges, let’s take a look at the traditional firms starting to stake a claim in the digital space. Many boast some of the largest global professional networks in not only the IT Services space but also across the consultancy space. In the Blueprint report, we researched and assessed many of the big traditional consulting firms such as Deloitte, KPMG, Booz Allen, and PwC that are trying to pivot their business models and reinvent themselves in the digital technology space[3].

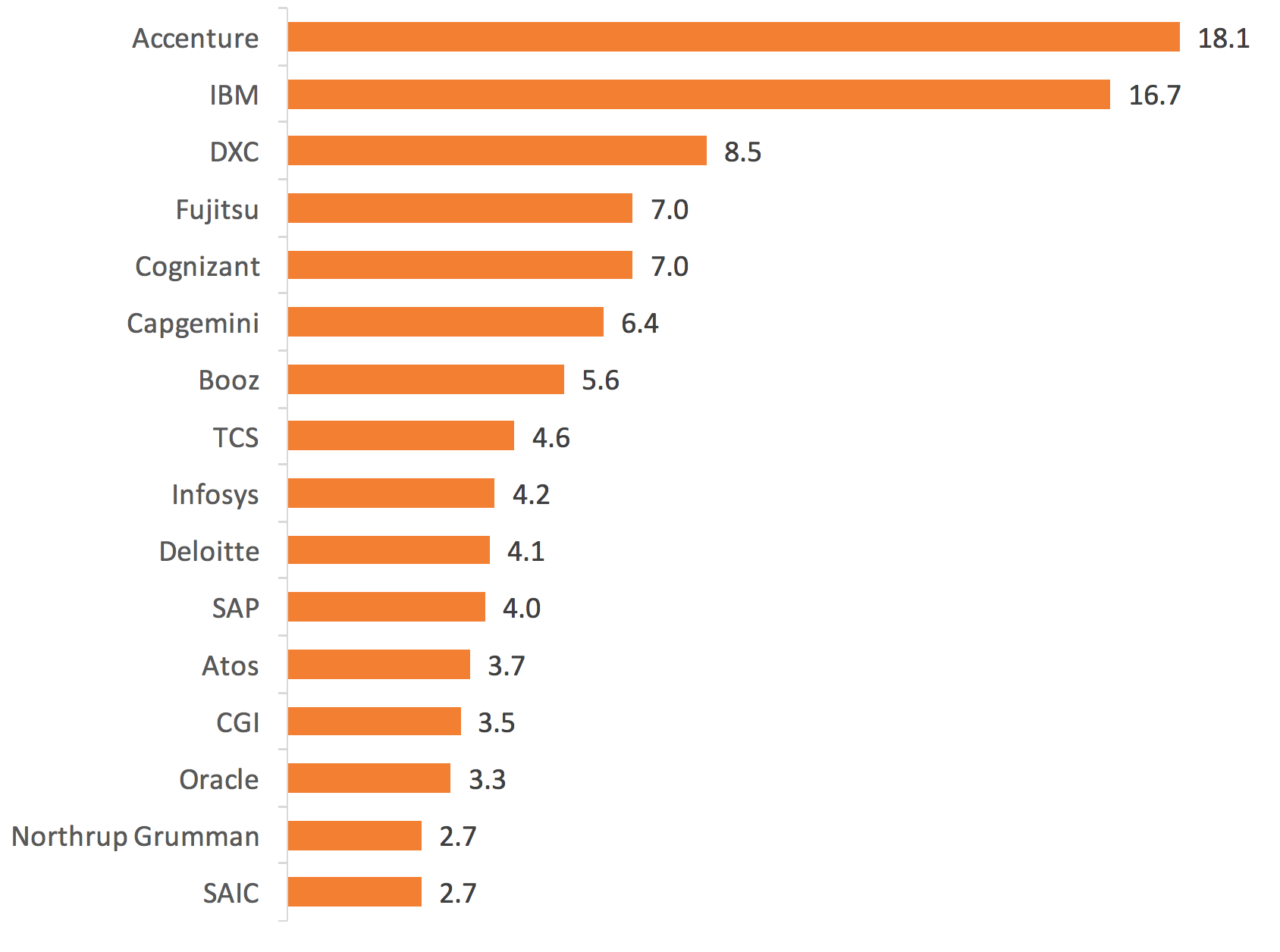

Exhibit 4: Top IT Professional Services Provider Revenues 2017 ($B)

Source: This chart shows our estimate of the IT professional services revenues for the leading providers. We estimate based on publicly stated financial statements.

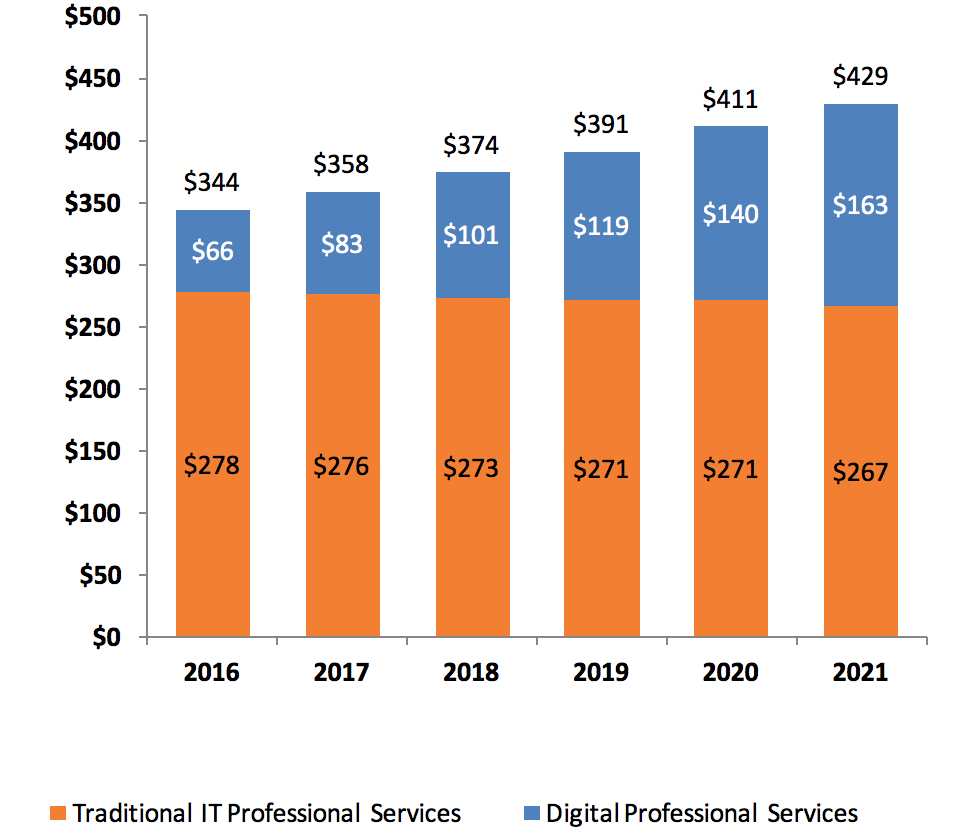

In Exhibit 4 we can see the strong positions of several traditional-focused consultancy firms, including Booz Allen and Deloitte. These firms will undoubtedly continue to develop their positions in the IT professional services space, particularly in the digital market where their exposure and experience in the broader business consulting market will support them in providing a unique perspective on the challenges of the modern enterprise. Crucially, as we can see in Exhibit 5, digital is predicted to take up a much larger share of overall IT professional services revenues, with signs of traditional revenues eroding, but the overall market growing steadily as digital engagements increase due to meet demand from enterprise clients.

Exhibit 5: Estimated Decline of Traditional IT Professional Services and Increase in Digital Professional Services Revenues

Source: HfS Research 2017. Based on estimate of the IT professional services revenues for the leading providers from publicly stated financial statements.

In summary, the Digital Technology Strategy and Consultancy market is becoming one of the key battlegrounds for digital and IT services providers. Firms already operating in the space are working hard to shore up their talent and expand digital offerings in a bid to carve out a bigger share of the growing market. Meanwhile, firms we’re more accustomed to seeing engaged in traditional consultancy are using their broader experience to move into the space and offer a unique perspective on IT and digital challenges. But, crucially, the positive-sounding rhetoric from vendors about moving away from technology-centred solutions needs to materialise for clients, who are now less-interested in technology and more focused on quality and innovation.

Bottom Line: The digital technology strategy and consultancy services space is becoming one of the key provider battlegrounds – with several skirmishes already taking place.

[1] The providers included in this research were Accenture, Atos, Deloitte, IBM, KPMG, TCS, Wipro, Booz Allen, Capgemini, CGI, Cognizant, DXC, EY, Fujitsu, Genpact, HCL, Infosys, NTT DATA, PwC, Syntel, and Virtusa Corporation.

[2] A Talent War Is Looming, and IT Services May Just Be the Super Weapon; HfS Research; 2017

[3] We use the word “traditional” in several places in this research and, indeed, in much of the supporting research in the IT Services space. For clarity, when we discuss “traditional consulting firms” we are referring to the broad range of consultancy firms that have historically focused on non-IT and non-digital business areas. When we discuss “traditional IT professional services” we are referencing forms of IT consulting that have focused on enterprise IT, rather than the broader digital technology piece.

Register now for immediate access of HFS' research, data and forward looking trends.

Get StartedIf you don't have an account, Register here |

Register now for immediate access of HFS' research, data and forward looking trends.

Get Started