In 2017, HfS Published the Infrastructure Management and Enterprise Cloud Blueprint report – the first in a series of Blueprints covering IT Services. The report tackled the well-developed and mature infrastructure management and enterprise cloud market – leveraging a vast quantity of data from over 300 Global 2000 enterprises to build a detailed picture of the market and twenty-two of the leading providers operating in the space.

In the process, we were able to uncover some of the key trends impacting the market currently – most notably the insatiable appetite for as-a-service infrastructure services and other key adaptations services delivery models, such as the shift towards partner-focused service brokerage models.

We will take the opportunity in this report to share some of the highlights of the research, who the key players in the market are, and the methodology that enables this and the other IT Services Blueprints to keep a finger on the pulse of the dynamic IT Services industry.

Demand for Traditional Infrastructure Services in Freefall as the Allure of As-a-Service Takes Over

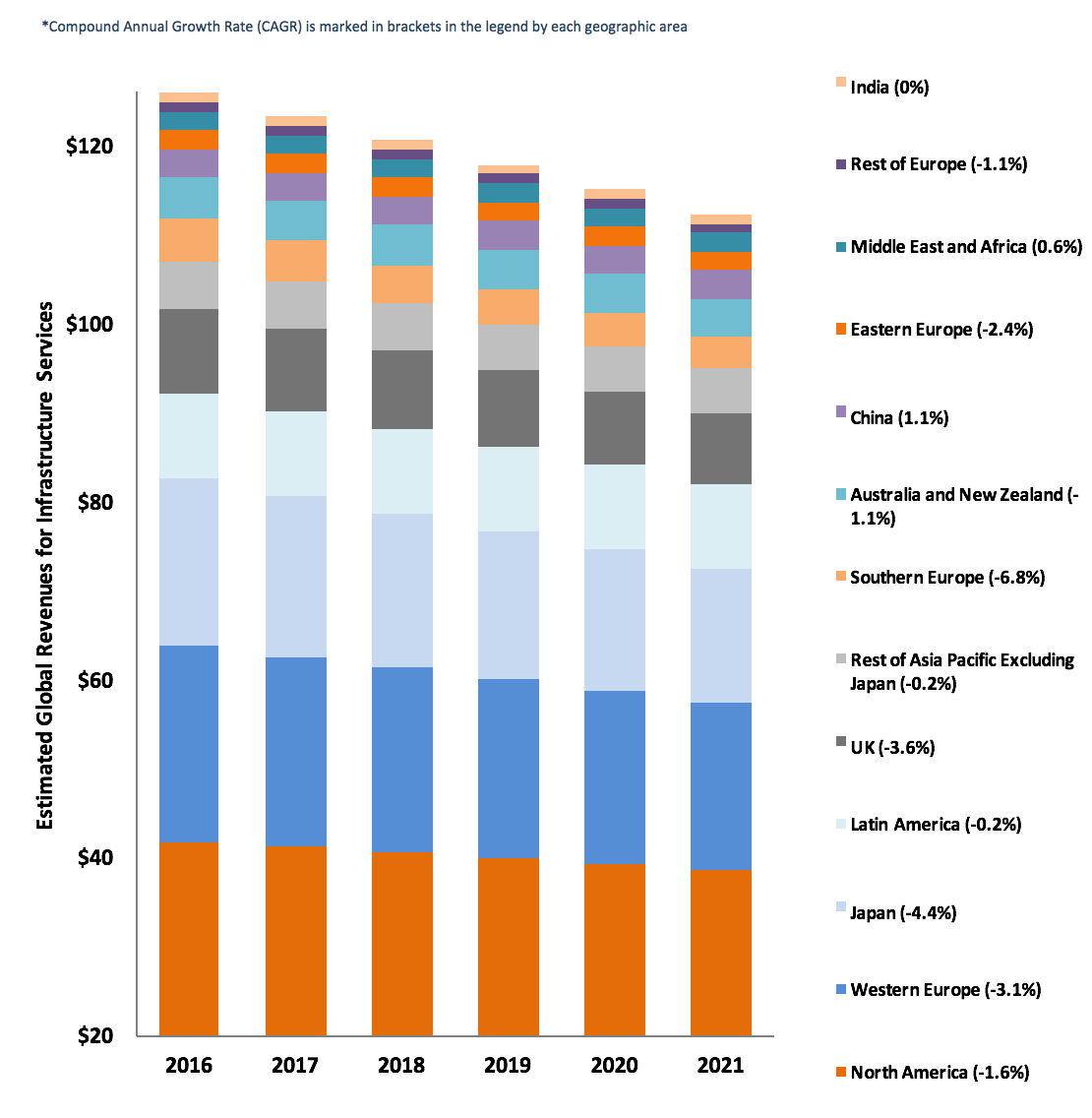

Without a doubt, the infrastructure management and enterprise cloud space are approaching a patch of turbulence as major industry trends take shape in the market. The first and most impactful trend is the insatiable enterprise demand for As-a-Service infrastructure and cloud services, which is spinning demand for traditional services into freefall. In Exhibit 1, we can see the estimated growth rate across the infrastructure services market based on geographic area. Notably, except in the case of China and the Middle East and Africa, revenues are tumbling across the globe, indicating a considerable contraction in the overall market value of infrastructure services.

At its root, this decline is due to a broader shift in enterprise demand as businesses opt for asset-light and cloud platform-based hybrid solutions, a dynamic exacerbated further by the meteoric rise of born-in-the-cloud as-a-service firms like AWS, which are better able to meet the dynamics of the market. Indeed, in 2017 AWS made its way into the top 10 high-value IT Services firms list[1], rising to compete with some of the more entrenched providers in the space. However, perhaps the most interesting part of this story is the contribution of service provider strategies to the downfall of traditional infrastructure services. In the Blueprint report, we discovered that a large number of the providers we analyzed were becoming more selective in the type of engagements they were taking on. With many advising that they would no longer actively pursue traditional-focused engagement and would instead opt for higher-value transformative work. Others have taken this move a step further by limiting infrastructure assets they hold and leveraging extensive partner networks (many of which contain the As-a-Service cloud providers that are taking chunks out of the market) to support clients.

We can more readily see the broader shift toward As-a-Service in IT outsourcing in Exhibit 2, which highlights the gradual erosion of traditional services as clients push for more As-a-Service offerings across IT, including infrastructure services.

Exhibit 1: Infrastructure Services Market by Region 2016-2021 ($B)

*Compound Annual Growth Rate (CAGR) is marked in brackets in the legend by each geographic area

Source: HfS Research 2017. Based on an estimate of the IT Infrastructure services revenues for the leading providers from publicly stated financial statements.

Source: HfS Research 2017. Based on an estimate of the IT Infrastructure services revenues for the leading providers from publicly stated financial statements.

Exhibit 2: IT Outsourcing Pivots Toward As-a-Service ($B)

Source: HfS Research 2017. Based on an estimate of the IT Outsourcing revenues for the leading providers from publicly stated financial statements.

Changing Client Demands Put Pressure on Infrastructure Providers

It’s clear to us that the infrastructure market has a turbulent time ahead, with providers reinventing their approach to infrastructure and wrestling to set out their stall in a complex market impacted by sweeping global trends. However, the large amount of data we gathered for this research – provided by over 300 Global 2000 companies – allows us to take a more detailed look into what’s shaping these demands.[2]

In Exhibit 3, we can see a great example of these shifting demands in action in the infrastructure space. The data, based on client feedback about the key influences for selecting a particular provider, are illuminating. For example, we can see that the partnerships a provider has with both cloud and software companies matter relatively little to potential clients, who are instead focused on the overall capabilities of the vendor to provide innovative IT solutions. And while we’re seeing providers shore up their partner ecosystems, this demand tallies up with increased emphasis clients are placing on As-a-Service engagements in which the provider manages the entire engagement, across their own and partner assets and offerings as required.

Exhibit 3: External Service Provider Selection Criteria

Source: HfS Research 2017, n=302 IT Services Clients

Crucially, this powerful client data also reveals a somewhat encouraging future for the infrastructure space. Exhibit 4 reveals the proportion of cloud delivery across core business technologies expected in the next two years. Simply put, the demand on cloud services is unlikely to be going anywhere but up, with the majority of clients highlighting a considerable proportion of their key business processes and technologies moving to the cloud within the next two years – perhaps a little comfort to providers to sooth the otherwise stormy forecast for the market.

Exhibit 4: Cloud Delivery Changes for the Next Two Years

Source: HfS Research 2017, n=302 IT Services Clients

Provider Highlights: The Movers and Shakers of the Infrastructure Space

As is often the case, in a market with so many trends and dynamics at play, there are some interesting providers developing approaches to differentiate themselves to clients and grow their market share. And while we can’t give everything away, there are some key players in the space that we can offer some insight on below. You can find full analysis of providers operating in the space in the full Blueprint report.

IBM is king of the castle: IBM has performed exceptionally well in this research – pushing the envelope in all key criteria across execution and innovation. To fortify its position, however, the firm needs to work to blend its infrastructure offering with other areas of IT services by breaking down traditional silos in line with trends across the market.

Accenture recognized for innovative solutions: While not able to match IBM’s execution capabilities, Accenture has given providers a run for their money as far as innovation is concerned.

AWS, Google, and Microsoft solidify positioning: These three born-in-the-cloud providers have solidified a strong position on the grid, scoring highly for execution but seeing limited innovation scores as the firm’s holistic infrastructure offerings are hampered by pure-play enterprise cloud services.

DxC offers considerable scale and global delivery: As one would expect from such a large merger, DxC now has the collected capacity of infrastructure assets and coverage to rival some of the giants operating in the space. Correspondingly, however, the firm needs to make sense of the merger and consolidate its portfolio to ensure its products and services aren’t anchored down by unproductive business areas.

Recent acquisitions including Office 365 specialist Tribridge and Dutch ServiceNow Integrator Logicalis SMC, demonstrate a commitment to shift portfolios toward post-digital / SaaS. The latest spin-off of its US public sector business should help fuel its investment. CSC undertook a similar process in 2015 when it span off its North American Public Sector BU to create CSRA.

Unisys holds its ground: With its heritage in hardware and mainframes, Unisys is a worthy competitor in the infrastructure space. While the firm’s offerings across IT Services can be blurry, its commitment to infrastructure is not in doubt.

WITCH providers holding firm: The WITCH providers – Wipro, Infosys, TCS, Cognizant, and HCL – hold a strong position in the infrastructure market. Since pioneering remote infrastructure management outsourcing, many of these firms have built up a considerable infrastructure management business. However, as the industry shifts towards As-a-Service and traditional revenues crumble, WITCH providers must work to differentiate their services and deliver the solutions clients demand. Some are achieving this by pushing the infrastructure envelope – captured in the innovation criteria of the Blueprint, while others have forged ahead in execution, bringing powerful assets, scale, and reach to engagements.

Pureplay service brokers take the field: Infrastructure assets such as data centers are important but not essential for providers to operate in the space. We’ve seen the entry of some firms more dedicated to service brokerage, and some, such as Hexaware, operating on a pure brokerage model. While this has hampered the firm’s scoring somewhat, it’s a testament to the diversity injecting into what has been a stale market, as firms strive to differentiate themselves to clients.

High potentials push ahead: We’ve also seen some firms with enormous potential enter the fray, with infrastructure comprising a strategic imperative for their wider IT offerings. Take Virtusa as an example; the firm is pushing hard in the space with infrastructure services comprising its highest growth area. This serves as a warning shot for some of the providers in the space, indicating that there is a raft of competitors building up their capabilities ready to stake their claim in the market.

You can find more information on the complex infrastructure management space, including detailed provider profiles and grid positioning for suppliers covered in the research in the Infrastructure Management and Enterprise Cloud Services Blueprint.

Bottom Line: The infrastructure services market is in for a bumpy ride, but with clients pushing more into the cloud there’s more than enough to keep providers busy.

[1] The 2017 High Value IT Services Top 25, HfS Research, 2017, https://www.hfsresearch.com/pointsofview/The-2017-High-Value-IT-Services-Top-25

[2] For a more detailed examination of client feedback demands and buyer perspectives captured from the Infrastructure Management and Enterprise Cloud Blueprint, take a look at the recently published The Good, the Bad, and the Ugly of Infrastructure and Cloud Services.

Register now for immediate access of HFS' research, data and forward looking trends.

Get StartedIf you don't have an account, Register here |

Register now for immediate access of HFS' research, data and forward looking trends.

Get Started