Banks are grappling with the dual challenge of aging legacy back-office systems and rapidly evolving technological demands. Neglecting these foundational systems isn’t just a minor inconvenience; it’s a ticking time bomb that can erode customer trust, lead to costly failures, and quietly drain profitability. This report is a critical call to action for CIOs in the banking sector. While back-office modernization may seem daunting and complex, the cost of inaction is far greater.

When the back office fails, the impact is instant. Transactions can’t be processed. ATMs go dark. Customers are locked out of their funds. They are unable to make payments and are effectively cut off from their bank. It’s a total blackout in which everything grinds to a halt.

The fallout is reputational damage, financial loss, and intense regulatory scrutiny. Take the Royal Bank of Scotland (RBS) incident of 2012, in which the customers of one of its banking brands were left without proper account access for weeks due to a system glitch—just one sign of an aging core.

Or look at Citigroup, where in March 2025, a routine copy-paste error resulted in $6 billion being mistakenly transferred to a single wealth management client, which was 1,000 times the intended amount. That jaw-dropping blunder forced Citi’s leadership to finally prioritize operational resilience and back-office overhaul. But this wasn’t their first stumble. In August 2020, Citi accidentally wired $900 million, instead of a $7.8 million interest payment, due to a clerical mistake tied to its outdated Flexcube system, which had not been updated since 2001 and was plagued by poor design.

These aren’t isolated incidents. They are symptoms of a deeper issue of underinvested and inefficient back-office systems. When they work, they go unnoticed. But when they don’t, the consequences are loud, costly, and often career-defining.

Years of mergers and acquisitions have left banks with a patchwork of back-office core systems, loosely integrated, often branded as ‘synergy,’ and tied up in long-term vendor contracts. Despite the clear risks of failure, modernization is frequently delayed. The core is mission-critical, deeply complex, and unforgiving, and there’s little room for error. No one wants to be the one who breaks the system.

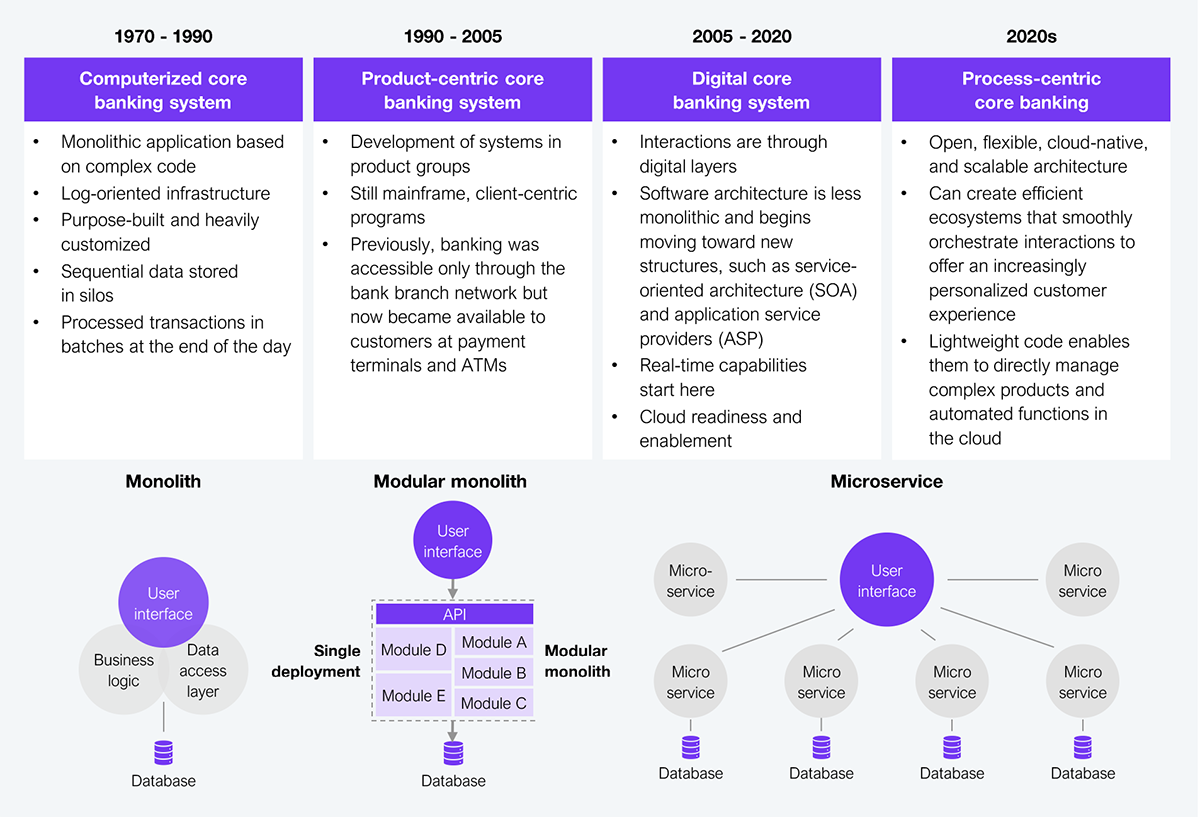

When we take a step back, the evolution of core banking systems, as seen in Exhibit 1, closely reflects the broader reinvention of the banking business. It’s the classic chicken-and-egg dilemma, where it is not clear whether the transformation of banking business drove changes in core systems or modern systems enabled new ways of doing business. Either way, the hesitation to modernize isn’t about technical inertia.

This isn’t a routine IT upgrade; it’s a fundamental reset of how a bank operates. It requires unwinding decades of undocumented workflows, retraining teams, and reengineering mission-critical processes from the ground up. That’s why it’s not surprising that the same core systems have been running since the 1960s. In banking, expiration is measured in decades, not years.

Source: HFS Research, 2025

For decades, the biggest fear in banking IT has been dismantling the mainframe. Yet, mainframes aren’t always a liability. These monolithic systems, hardwired to handle the full scope of banking operations, are remarkably stable, secure, and capable of processing high volumes of transactions at speed. Their drawbacks are rigidity and slow adaptability.

Often considered the ‘Fort Knox’ of banking enterprise data, mainframes securely house critical banking information. Rather than replacing them, a more strategic approach is to tap into their massive processing power and data storage capabilities by bringing AI to these systems—essentially, teaching an old dog new tricks.

Augmenting the mainframe with AI will enable banks to automate, streamline, and optimize IT infrastructure and operational workflows. It will also support real-time fraud detection using transactional data, apply GenAI to summarize documents processed on the mainframe, and facilitate application modernization by translating legacy code into modern languages.

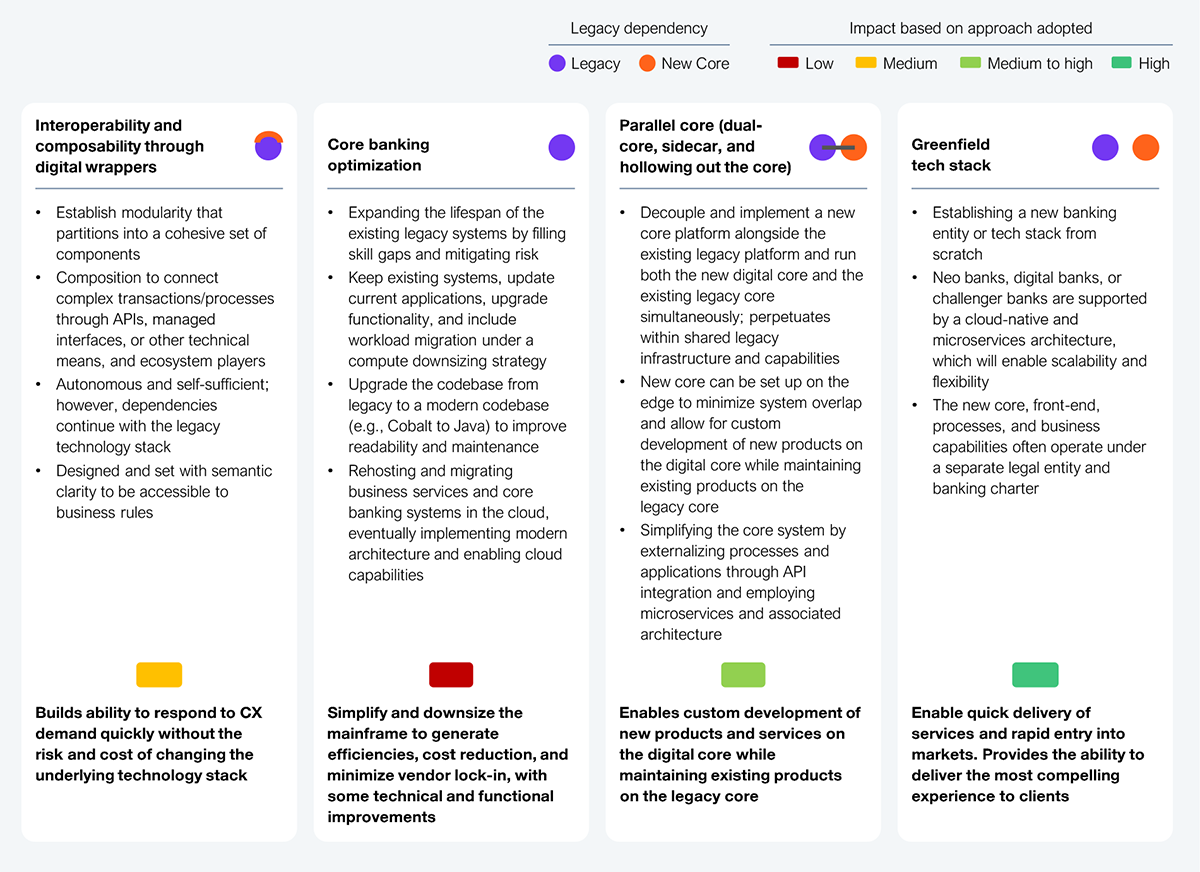

Staying on the mainframe and augmenting it with AI is one way to achieve a certain level of modernization. However, full-scale modernization typically requires decoupling from the core, most often following two proven paths. Other practical modernization approaches are also illustrated in Exhibit 2.

The first approach involves hollowing out the existing core to enable more modular functionality aligned with future needs. This can include refactoring the codebase into a modern language and then modularizing it into components based on a target architecture. This method helps retain core stability while enabling incremental innovation.

The second approach is to carve out specific product segments and run them on a next-generation core platform, gradually migrating customer bases over time. This allows teams to test, learn, and scale.

Both methods are grounded in smart decoupling, creating just enough separation between systems and services to evolve what matters, when it matters.

Source: HFS Research, 2025

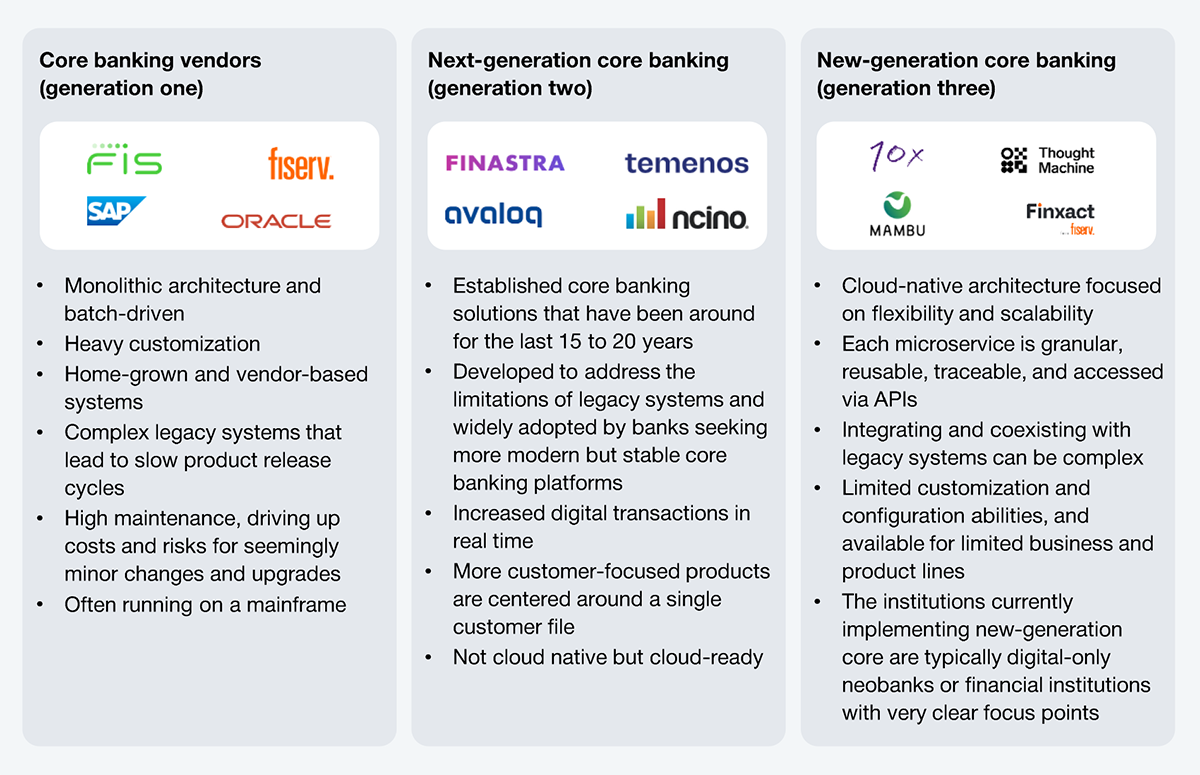

Modern core platforms are cloud-ready, open banking compliant, and designed for interoperability. They are built on the banks’ ability to expose discrete components of their core systems for integration with other systems, while consuming modular components from third-party platforms, enabling seamless ecosystem participation. Exhibit 3 illustrates the evolving technology postures of core platform providers, highlighting how vendors are positioning themselves to support the shift toward modular, interoperable, and intelligent banking infrastructures.

A key evolution of these platforms is real-time processing, enabled by event-driven architecture. Data is no longer siloed; it is organized using customer-based taxonomies, creating a unified view across products and services. This structure supports hyper-personalization, as each customer can be intelligently linked to multiple offerings, channels, and real-time interactions. These platforms are also written in modern code, fully leveraging agile practices, DevSecOps architectures, large-scale data sets, high-speed networking, containers, and cloud infrastructure.

Source: HFS Research, 2025

Core systems are rarely touched and often for good reason, which makes back-office modernization a tough sell for any CIO. But avoiding it only deepens legacy debt and keeps the organization stuck in outdated, 20th-century banking practices. Upgrading back-office systems isn’t just an IT project; it’s a fundamental shift designed to unlock greater agility, support the integration of AI, and enhance decision-making capabilities. The longer modernization is delayed, the more complicated and expensive it becomes.

Register now for immediate access of HFS' research, data and forward looking trends.

Get StartedIf you don't have an account, Register here |

Register now for immediate access of HFS' research, data and forward looking trends.

Get Started