Outsourcing models must be able to support change and be strategic, future oriented, agile, scalable, automated, and cost effective. In the Nearshore Americas Expert webinar on January 30, 2020, six industry leaders discussed the best courses of action in response to the effects of automation on the outsourcing industry. The goal: a simplified core outsourcing ecosystem.

As the global market shifts, talent becomes a higher priority over lowering costs

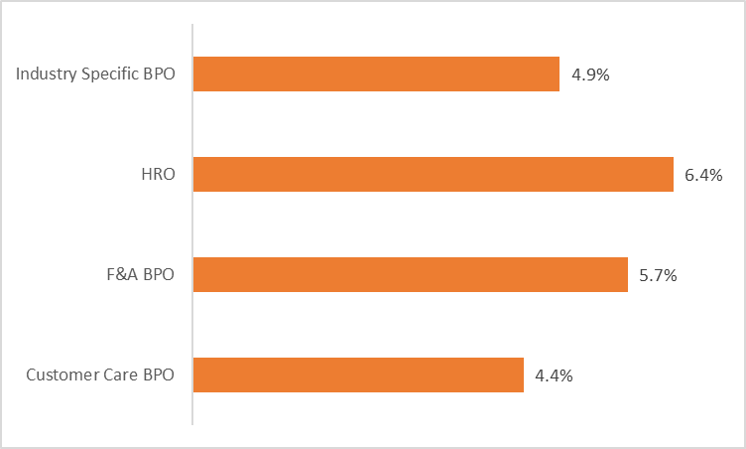

HFS forecasts F&A BPO (business process outsourcing) growth at a 5.7% CAGR between 2018-2023 (see Exhibit 1). Different value levers affect this growth, including nearshore delivery operations for the North American market as a way to find and scale talent. Automation reduces the demand for low-skilled jobs. Therefore, higher-skilled workers are increasingly valuable, as processes place more emphasis on the complexity and quality of work.

Exhibit 1: With such a strong potential for growth, F&A BPO buyers must adapt to shifting value chains

Global BPO compound annual growth, 2018-2023

Source: HFS Research 2019

When establishing any new location for F&A operations delivery, enterprises often very strongly consider the cost and quality of production. Talent is included in cost and margin pressures alongside market forces and environmental restraints. Government organizations’ support for their countries is exceedingly important as they must model themselves to the needs of investors, including training support services (grants), rent-free incubation spaces, regulatory support, incentives, and workforce development potential for the future. This makes it easier for ambassadors to establish an industry in the desired location.

BPO buyer participants in the Nearshore Americas Expert webinar indicated that they had seen an enormous increase in the use of automation in their operations as a whole. Technology integration has impacted BPO by making tasks formerly completed by hand easily resolved digitally, thus reducing industries’ desire for low-skilled employees. At the risk of increasing company costs, infrastructure capabilities and workforce quality are critical when selecting locations to do business. State-side automation has great potential due to continued advancements in security and infrastructure. Enterprise leaders attending the webinar deemed the United States is a strong candidate for nearshore enterprises due to the potential for acquiring a highly skilled workforce in automation and technology. This combination, although higher in initial expenses, will create a strong technological baseline for enterprises and eventually promote growth and success.

Environmental constraints play a huge role in business continuity for nearshore operations

Many outsourcing providers speaking at the Nearshore Americas Expert webinar spoke of their consideration of locations in the United States, Latin America, and the Caribbean when selecting locations strong in talent over cost. The conversation of environmental restraints landed on natural disaster protection; leaders specifically mentioned a need to select areas above or below the hurricane belt to prevent outages or damages. Assessing the potential for hurricanes or tropical storms is a huge component of risk mitigation consideration when assessing these locations.

Outsourcing service providers and clients must be able to comment about the effects of climate change on their enterprise

As the severity of the hurricane belt became a recurring subject of discussion in the webinar when considering the Caribbean for business operations, weather conditions and the climate became exceedingly important alongside technology advancement when considering the possibility of power outages disturbing workflow.

The conversation of climate change specifically has become unavoidable when discussing the future of business. When questioned directly about the effects of climate change on location selection, executives at the webinar were hesitant. While there was general agreement about the importance of considering climate change, sourcing leaders must be prepared to respond with how their organization is strategizing around the potential impacts. This is especially important as a large consideration in the outsourcing industry rests upon environmental constraints. Executives must be able to address these concerns, especially when speaking of outsourcing models. Skirting the need to address climate change specifically while continuing to address environmental pressures that innately coincide does not reflect well on enterprises.

The Bottom Line: Financial services BPO buyers must rise to the times and prioritize the needs of technology and the environment in order to maintain success.

In this increasingly digital world, antiquated outsourcing models prioritizing cost over quality are becoming less successful in the marketplace. As enterprises look toward technology to strengthen and expand their practices globally, they must learn to adapt to all variables and constraints present beyond cost. Buyers must consider technology potential, employee potential, politics, and environmental constraints when considering nearshore endeavors.

Register now for immediate access of HFS' research, data and forward looking trends.

Get StartedIf you don't have an account, Register here |

Register now for immediate access of HFS' research, data and forward looking trends.

Get Started