Transitions, which involve the structured movement of work, processes, and capabilities from enterprises to internal global capability center (GCC) or shared services teams and outsourcing providers, remain one of the most misunderstood and underused levers of enterprise value within global services transformation initiatives. While most transitions deliver cost and continuity, they fall short on paving the path for agility, transformation, and defining business outcomes.

Transitions have outgrown their role as administrative handovers and should now represent the foundational operating model for the Services-as-Software™ (SaS) era. As enterprises shift to artificial-intelligence-infused service delivery, transitions test resilience, capture knowledge, and build or compromise future-readiness.

HFS Research and Infosys BPM surveyed 153 business and functional leaders and 152 transition management team leaders from GCCs and service providers. The research reveals a consistent headline: Transitions are not meeting strategic expectations for either enterprises or their transition partners, underscoring the need for stronger co-ownership, design discipline, and trust across all involved parties.

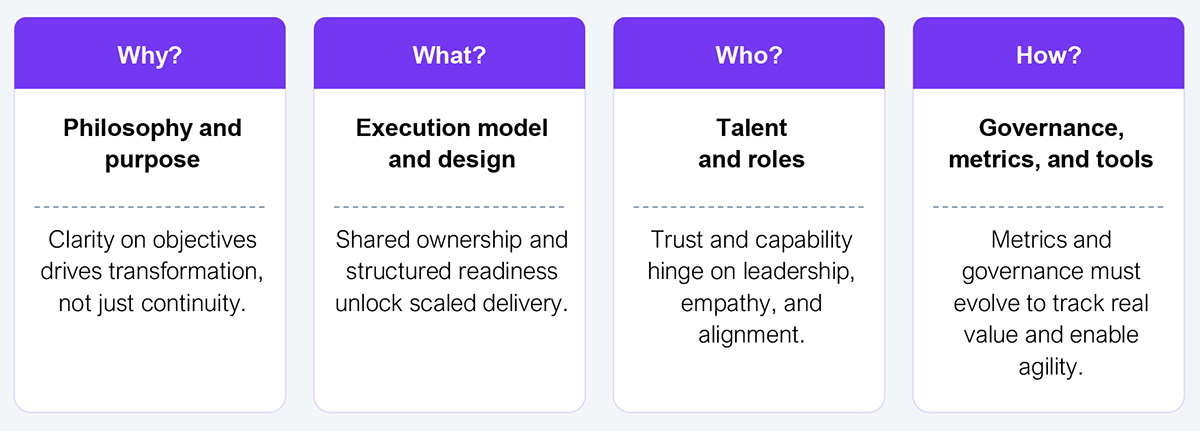

This report lays out a transition playbook structured around four foundational pillars, designed to guide both enterprise leaders and transition management teams in building co-owned, future-ready operating models.

These dimensions form the foundation of what must become “capital T” Transitions—cross-functional, co-owned, and designed for continuous capability building. Most current efforts remain stuck in “small t” transitions—tactical projects focused on stabilization. Elevating transitions means rethinking their purpose, not just improving their execution.

To read the complete report, click the download button below.

Register now for immediate access of HFS' research, data and forward looking trends.

Get StartedIf you don't have an account, Register here |

Register now for immediate access of HFS' research, data and forward looking trends.

Get Started