Mortgage companies are accelerating GenAI adoption to eliminate time-consuming manual workloads, but most are still scratching the surface and are yet to unlock its deeper, transformative value. The most common use case in the mortgage industry is intelligent document processing (IDP), powered by domain-specific large language models (LLMs) to automate document collection and processing at the loan origination stage. It’s popular for good reasons: faster ROI and relatively low risk. But to stay competitive, mortgage leaders must move beyond document automation and simple chatbots. The next frontier is leveraging GenAI and other technologies such as ML and NLP to drive smarter, predictive, and customer-centric loan journeys. This shift isn’t just about efficiency and reducing lending cost. It’s about gaining a competitive advantage by tying productivity gains with innovation, customer experience, and market agility to realize the immense potential of GenAI and agentic AI.

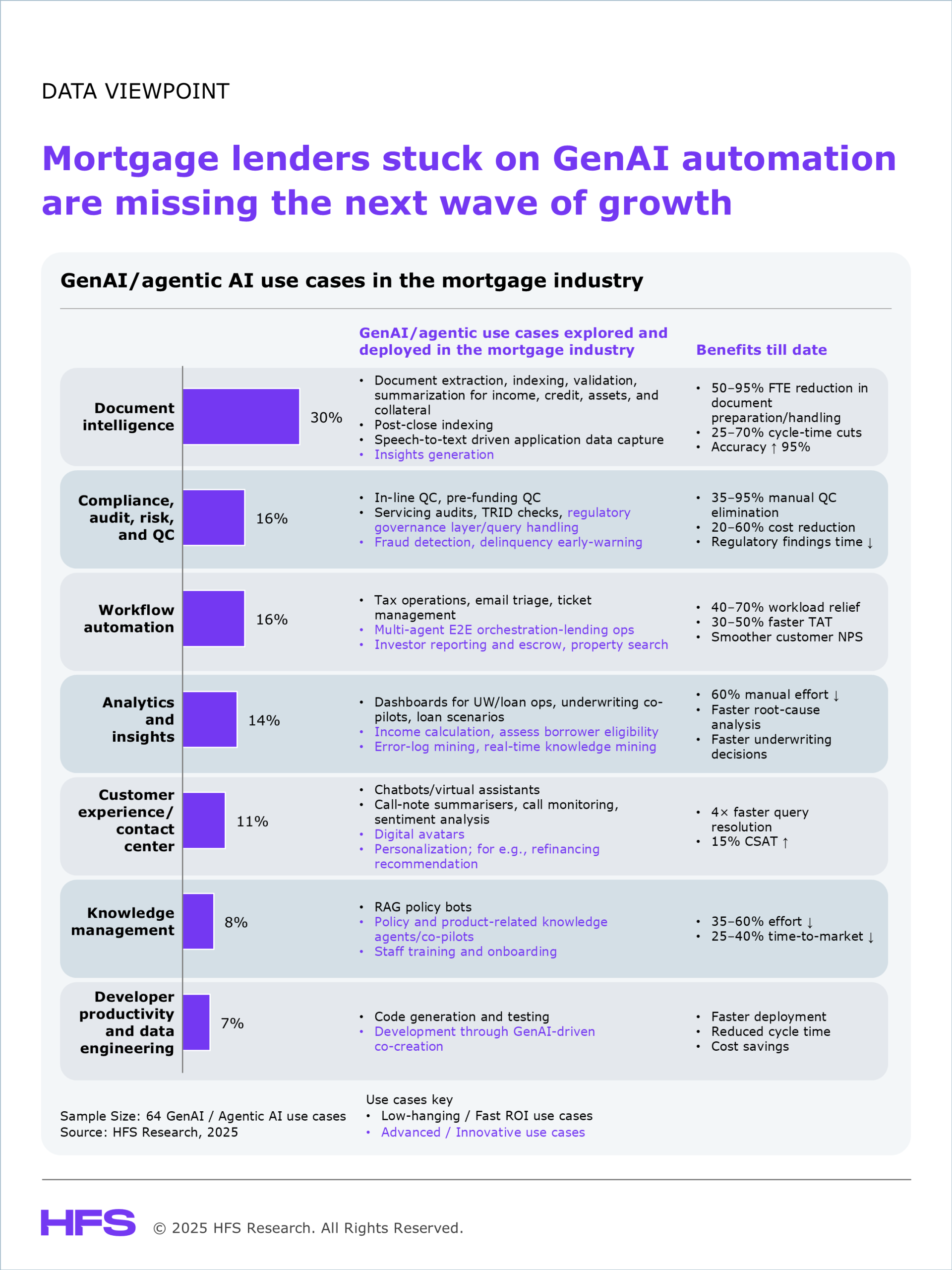

In our recent “HFS Horizons: The Best Service Providers for Mortgage Re-invention, 2025” assessment, we interviewed the top 15 service providers and 40 mortgage clients and partners for GenAI adoption in the mortgage industry. They revealed how GenAI is reshaping the value chain by automating and rethinking how work gets done across the mortgage value chain, from underwriting co-pilots to agentic orchestration. The exhibit above illustrates key GenAI use cases and benefits, currently being explored and deployed in the mortgage industry.

Here’s how mortgage leaders can unlock AI’s full potential beyond incremental ROI by improving operational efficiency:

Now is the time to challenge legacy systems, raise the bar on GenAI ambition, and demand more from partners because efficiency alone won’t win the next mortgage war. Success will depend on balancing innovation with compliance. Tomorrow’s leaders will be those who go beyond cost savings to create intelligent, resilient, and personalized mortgage ecosystems.

Register now for immediate access of HFS' research, data and forward looking trends.

Get StartedIf you don't have an account, Register here |

Register now for immediate access of HFS' research, data and forward looking trends.

Get Started