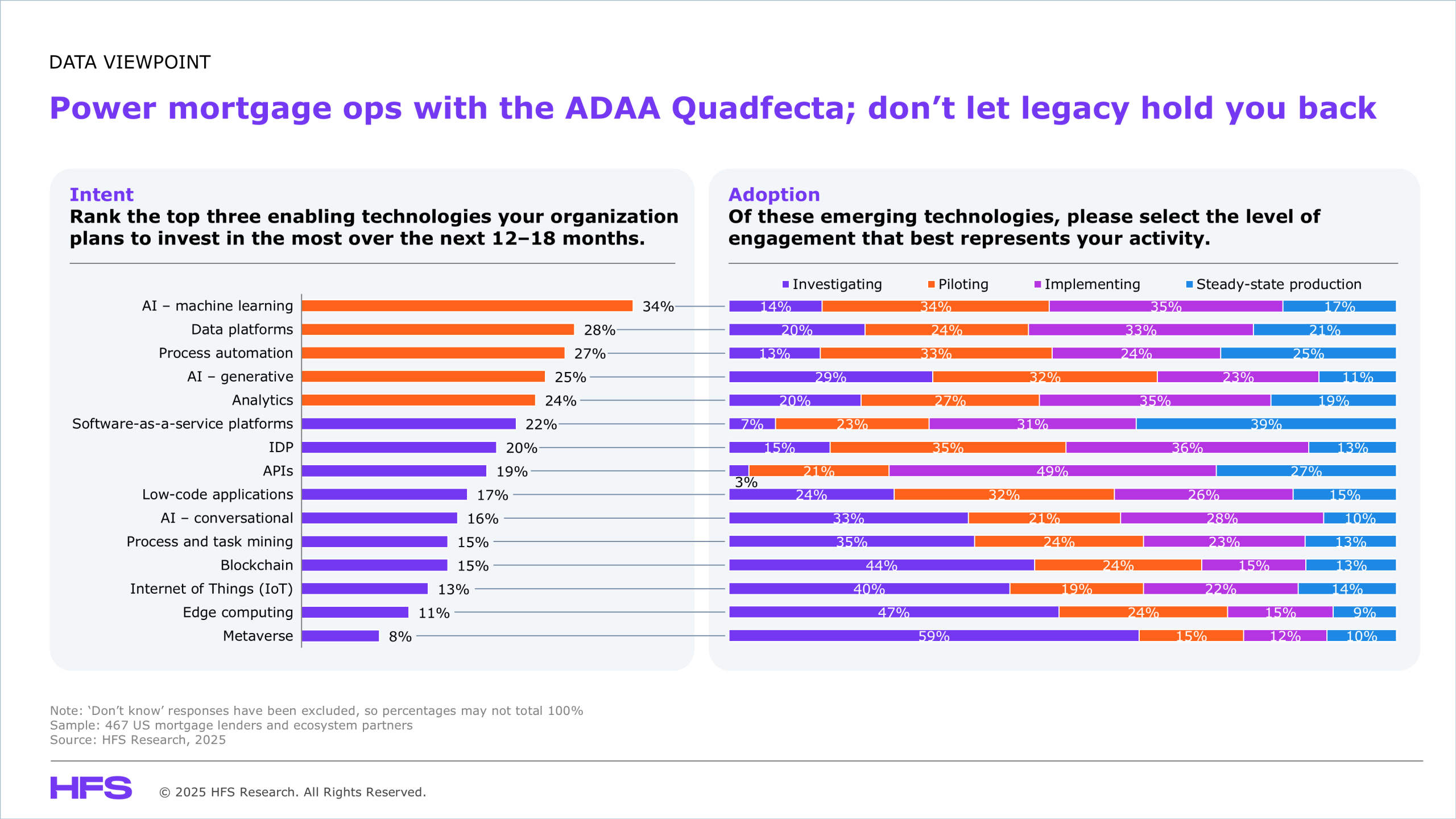

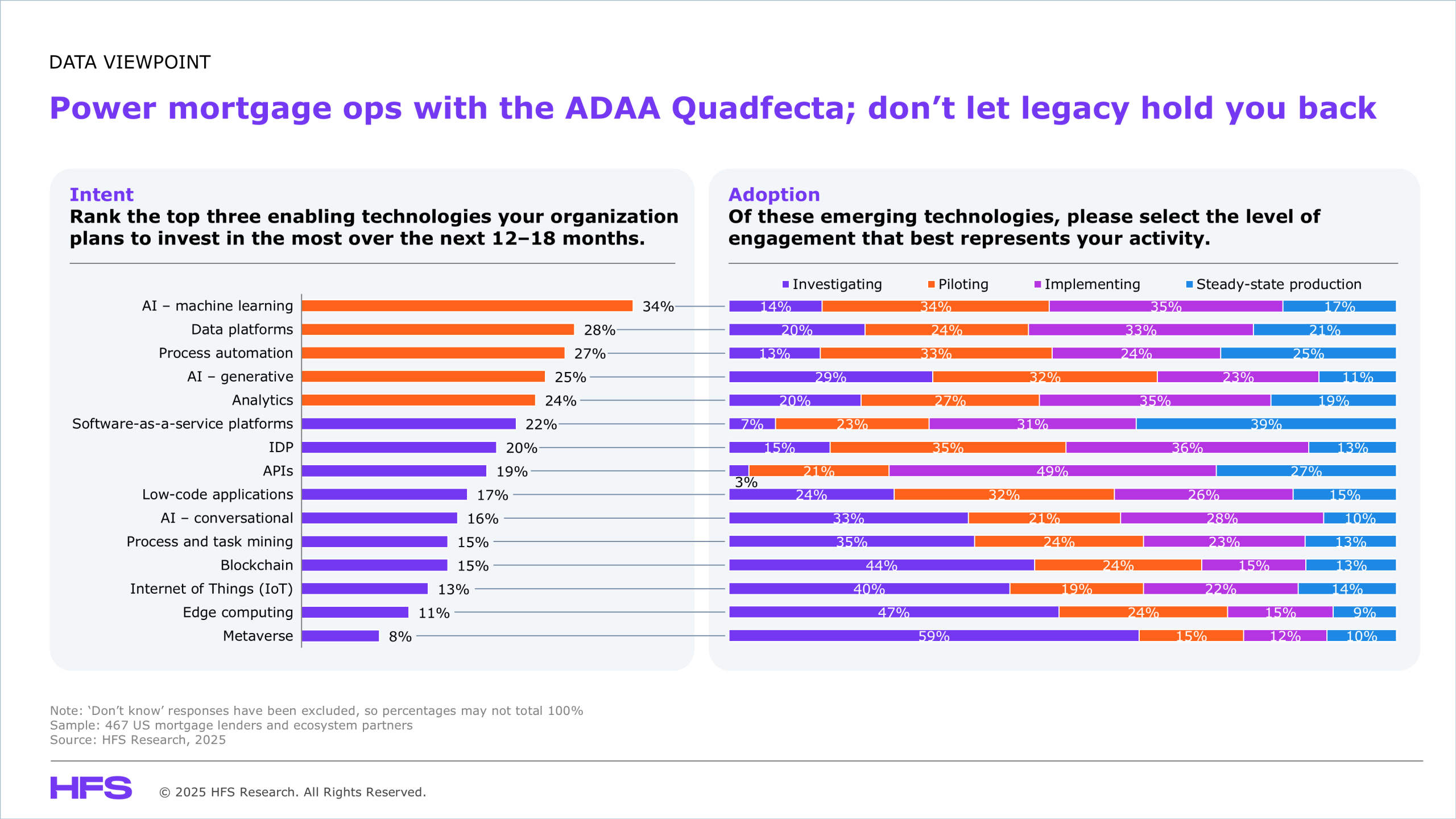

Mortgage providers have zeroed in on their frontier technologies—AI/ML (34%), data platforms (28%), automation (27%), generative AI (25%), and analytics (24%)—an interconnected arsenal that’s both complementary and catalytic, powering the most promising parts of the mortgage operations value chain. While these technology investments sound ambitious and strike the right chords for what the industry needs, actual adoption is still far behind the ambition.

Considering both the strategic intent and adoption levels, we distilled key insights from decoding the technology trends in mortgage operations (see Exhibit 1):

- Mortgage operations simply can’t scale on people alone; technology is the real lever to offset brutal margin pressure. Mortgage economics is unforgiving: labor costs are high, pricing power is thin, and borrower loyalty is fleeting. Originators and servicers are trapped in the same grind: commissions slicing into profits, fees driving churn, and rising cost-to-serve squeezing every deal. Done right, technology can finally bridge that gap. It’s encouraging to see the ambition retire the old “butts in seats” model, giving way to the AADA Quadfecta—automation, analytics, data, and AI—bringing cognitive and predictive intelligence with streamlined data across mortgage operations.

While the spotlight technologies form the AADA Quadfecta arsenal, intelligent document processing (IDP), ranked sixth, is an unsung hero that connects the analog and digital worlds. Mortgage processes live and die by documents, and IDP brings the much-needed speed and precision through advanced classification, extraction, and algorithmic processing. While downstream, it feeds into the higher layers of technology like automation, analytics, and AI that sit on top.

- Technology adoption isn’t keeping pace with ambition. The technology trajectory follows a well-worn path—invest, pilot, implement, and scale. It starts with a solid business case but rarely reaches full enterprise rollout. Mortgage providers show intent but fall short in adoption, with steady-state adoption stubbornly low across AI/ML (17%), data platforms (21%), generative AI (11%), and analytics (19%). Only automation breaks the pattern at 25%.

The reason is most lenders are ill-equipped to deliver and scale technology in compliance-heavy environments that demand a full-stack rethink while keeping legal and regulatory guardrails intact, ultimately stalling adoption. Add in years of industry consolidation, and the result is a tangle of silos, fragmented data architectures, and overlapping platforms born from M&As. Then there’s the real anchor: the reliance on legacy loan origination system (LOS) giants whose slow and inflexible innovation cycles keep lenders’ digital ambitions firmly grounded.

To succeed with their technology initiatives, lenders must:

- Build for integration and not for isolation: Most lenders struggle because their technology infrastructure is fragmented across multiple platforms inherited from M&As and legacy LOS systems. To scale effectively, they must focus on platform modernization—building a foundational infrastructure that enables automation, AI, and data to flow seamlessly. This means replacing outdated systems that no longer serve the business with modern, integrated architectures designed to scale technology effectively.

- Align ambition with execution readiness: Lenders often have bold technology ambitions but lack the operational and compliance frameworks to deliver. Scaling technology requires governance discipline: rethinking processes, ensuring data accuracy, and building controls that meet regulatory requirements while enabling innovation. The goal is to create a tech ecosystem that can adapt and grow without getting bogged down by compliance.

- Partner to scale and don’t go in alone: Lenders should partner with service providers that bring domain expertise, AI capabilities, and modernization experience. The right partners can help lenders orchestrate change across people, processes, and platforms, bridging the gap between ambition and scalable execution.

The Bottom Line: Don’t wait for perfect conditions to build the technology muscle needed to succeed in your mortgage business.

Many lenders are tangled in institutional complexity, hesitating to move until there’s a watertight business case or guaranteed ROI. But in a hyper-competitive, margin-thin industry, waiting for perfect conditions is a losing strategy. If lenders don’t scale through technology now, they risk getting unseated fast.