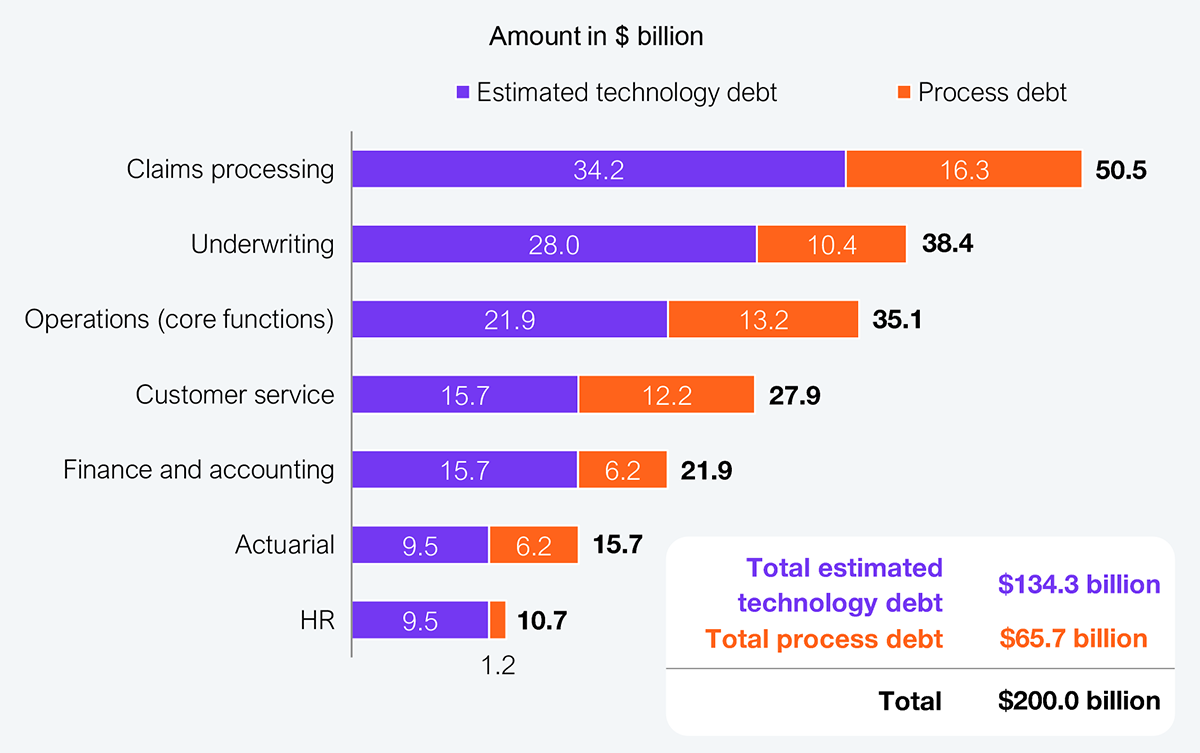

The insurance industry is staring down a $200 billion mountain of process and technology debt, according to HFS Research. In the life and annuity (L&A) space, legacy systems, fragmented workflows, and outdated operating models have stifled agility and performance, pushing the cost-per-policy in the wrong direction. At the same time, regulatory pressure is mounting. Capital adequacy rules, consumer protection mandates, and evolving regulatory frameworks add layers of complexity and costs. Combine that with ongoing talent shortages, and it’s not hard to see how this industry has racked up this debt. Yet, embedded in that debt is a massive opportunity: L&A carriers stand to unlock $10–20 billion in productivity and innovation value by leveraging next-gen business process services (BPS) models, not just as outsourcing, but as a process and technology lever for operational reinvention.

Source: HFS Research, 2025

Recognizing the scale of the challenge, HFS Research partnered with DXC Technology (hereafter DXC) to take a deeper look at how leading North American L&A insurers are navigating entrenched operational constraints to reimagine a bold, future-ready operating model. This paper draws on HFS Research’s industry-leading data and insight-rich conversations with six senior executives from top L&A organizations, underscoring that true modernization requires more than just technology—it demands operational reinvention, educating and driving mindset shifts, and the right strategic partnerships. The next-gen BPS model—offered by providers like DXC—blends deep domain expertise, operational rigor, and tech-led capabilities to help L&A carriers meet the moment in the North American market.

Our research found that enterprise insurers have tapped out value from traditional BPO models. Labor arbitrage and lightweight process improvements can’t generate the desired outcomes. As a result, they’re shifting from task outsourcing to end-to-end BPS solutions focused on outcomes, while service providers are taking on process redesign. This puts the spotlight on providers that deliver productivity, speed to market, and customer value while infusing automation, AI, and digital capabilities, not just low-cost labor.

DXC has further leaned into this shift by integrating its Assure platform and deep insurance expertise with ServiceNow’s AI and workflow capabilities to drive process transformation, embed technology innovation, and unlock greater value from existing investments in carriers’ policy administration systems (PAS). The result is seamless end-to-end integration across a complex ecosystem.

Traditional offshoring may have delivered cost savings in the past, but its dominance has faded due to rising offshore labor costs, attritional impacts on operational quality, and higher process demands. Process-led technology is replacing labor, and this is a key component of end-to-end BPS solutions.

As a senior managing director at TIAA put it bluntly:

Today, third-party providers must partner in delivering real business outcomes, not just provide services.

— Senior Managing Director – Deputy Head, TIAA Global Capabilities

An insurance operations leader at Lincoln Financial also echoed this sentiment:

Providers must evolve beyond offshoring. Insurers now expect them to integrate automation, AI, and digital solutions—making them strategic enablers, not just cost-cutters.

— SVP, Insurance Operations, Lincoln Financial Group

This redefinition of the insurer–third-party relationship is already reshaping service delivery. A large North America–based L&A insurer offers a case in point. Historically, the firm transitioned work offshore in a piecemeal fashion. But without giving vendors full ownership of end-to-end processes, real transformation was difficult to achieve. The company is now focused on value chain-driven service delivery, and that approach is delivering more transformational benefits.

Commercial models are also evolving. Outcome-focused pricing is no longer aspirational—it’s becoming standard in BPS contracts. TIAA Global Capabilities commented that they’re actively leveraging more outcome-focused, product-oriented delivery models in addition to traditional time-and-materials arrangements. The message is clear: strategic BPS partnerships, not transactional outsourcing, are becoming the backbone of insurance innovation.

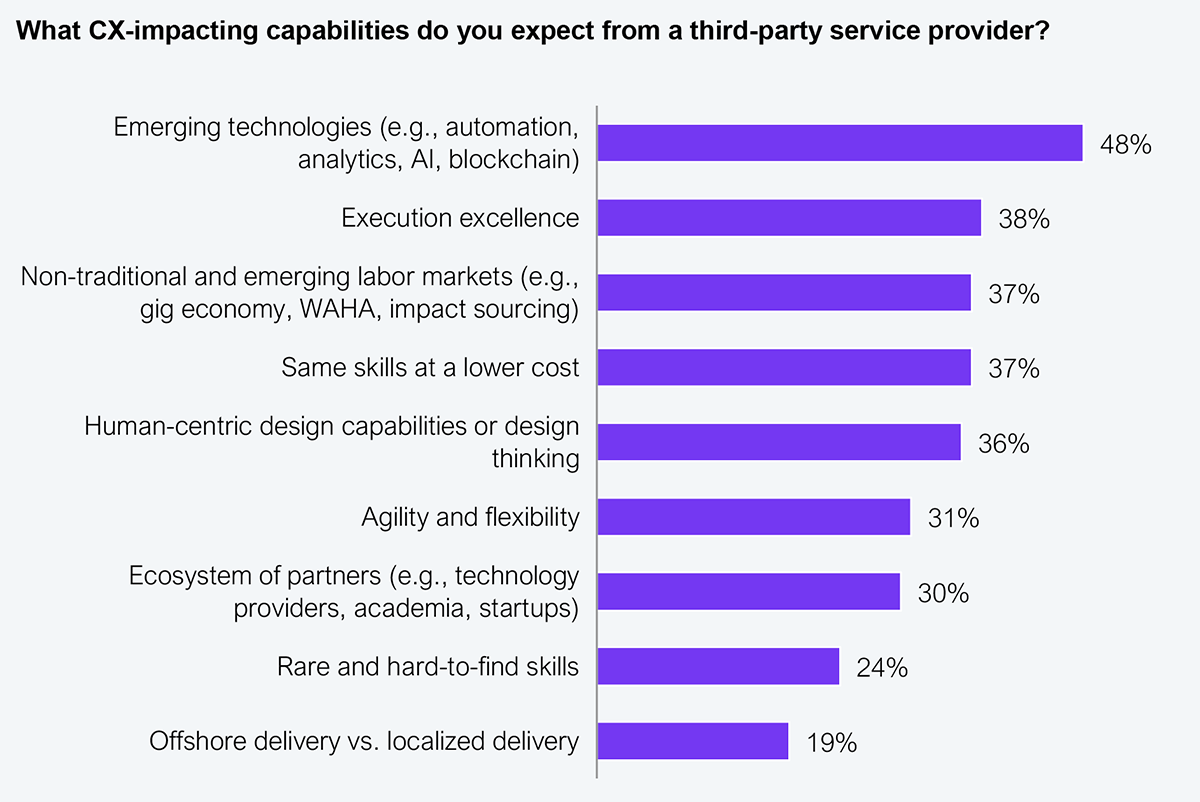

This shift is particularly visible in customer experience transformation. When asked what they need from third-party providers, insurers ranked emerging technologies—automation, AI, and analytics—well above labor arbitrage (see Exhibit 2).

Sample: 105 North American L&A leaders

Source: HFS Research, 2025

While access to talent still matters, insurers are now prioritizing providers that accelerate customer value, improve speed to market, and deliver cost efficiency.

If freed from today’s constraints, the future operating model would be digital-first, highly agile, and deeply customer-centric. Executives shared that vision with us, but the reality on the ground doesn’t yet deliver on that promise.

Although the pandemic and rising interest rates gave L&A carriers a temporary lift—boosting mortality product sales, enhancing savings-linked offerings, and drawing private equity interest—this momentum is not sustainable. The sector remains under pressure as the protection gap widens, price-to-risk alignment remains elusive, and competition intensifies from banks, asset managers, and digital-native investment platforms. Demographic shifts—swelling retiree population, increasing Gen X wealth, and evolving family structures—are reshaping demand. At the same time, policyholders now expect hyper-personalized, digital-first experiences, putting the traditional broker-driven model under strain.

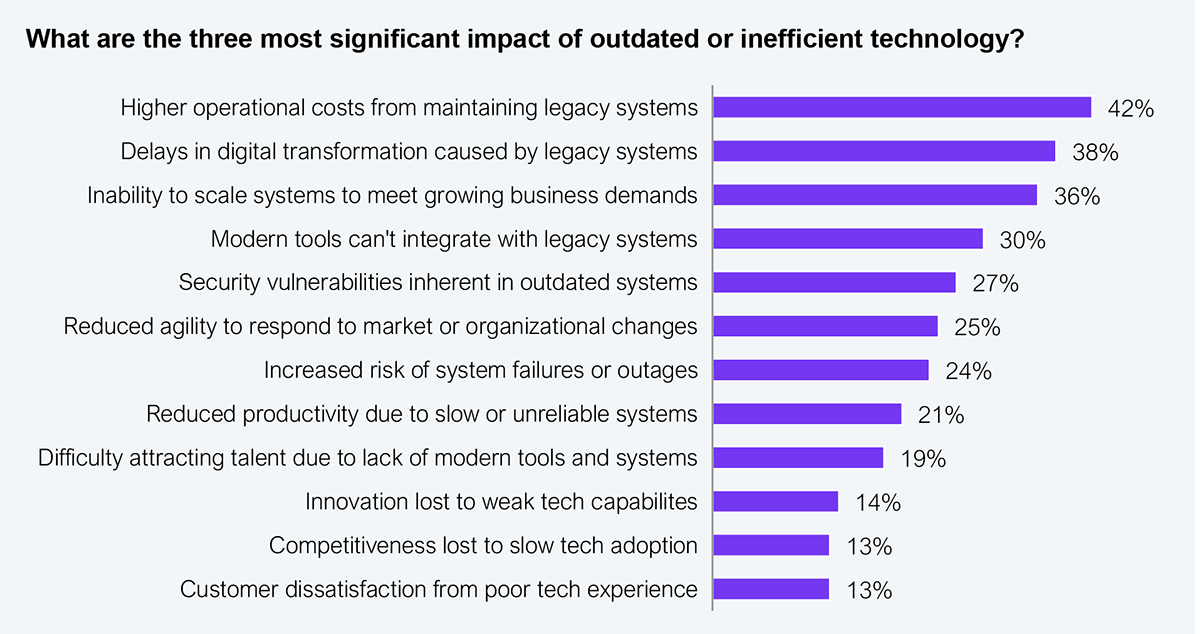

Vendor-led platforms have introduced point solutions such as automated underwriting, workbenches, third-party data APIs, and visualization dashboards that deliver incremental value. Though useful, this has contributed to the technology debt, resulting in higher operational costs and an inability to scale due to technical and interface limitations, as illustrated in Exhibit 3.

Sample: 118 Global 2000 enterprise leaders

Source: HFS Research, 2025

Carriers tethered to these platforms can’t afford to wait for all this to come together; progress moves only as fast as the slowest partner. This tension was underscored by an insurance leader in transformation and operations, reflecting on the difficulty of aligning past vendor decisions with today’s AI advancements:

The biggest challenge we face is that the decisions made three years ago to drive transformation with a tech-first approach now collide with the rapid evolution of generative AI and agentic automation. Balancing long-term IT commitments with new-age AI capabilities is a constant challenge.

— Digital transformation and operations leader of a large North American L&A insurer

This is where next-gen BPS becomes a game-changer—not by replacing past tech investments or throwing more bodies to support the problem, but by orchestrating them. BPS providers can overlay intelligent automation, integrate fragmented systems and data, accelerate AI adoption, and enable human-in-the-loop. Moreover, it doesn’t require ripping out existing infrastructure but starts with re-evaluating the operating model to identify the architectural gaps, needed capabilities, and high-impact investments. That means adopting fit-for-purpose technologies, smarter workflows, and greenfield approaches that bypass legacy constraints.

There is no one-size-fits-all model. The key to winning is continuously adapting, reading the market, reassessing priorities, and evolving operations to stay ahead.

— Operations head of a leading Iowa-based insurer

L&A insurers no longer have the luxury of linear transformation. BPS enables carriers to move from reactive fixes to proactive future operating models. Next-gen BPS comes closest to delivering exactly that through strategic outcome-focused partnerships that blend process and technology.

In the previous section, we made the case to reimagine your operations with a next-gen BPS. Whether you’re starting from siloed, uncoordinated efforts or looking to scale into a fully integrated, end-to-end program anchored around the policyholder journey, the time to act is now.

No matter your current state or ambition, the following goals are essential for modernizing L&A operations through BPS or future-proofing the BPS model you already have in place. Let’s break down how to frame BPS across three levers of transformation:

Carriers must recognize, and most will admit, that they lack the in-house expertise and agility to execute and deliver complex transformation at scale. The gap isn’t just strategic—it’s structural. Even when initiatives are launched, they often stall due to organizational fatigue and resistance. Employees may understand the ‘why,’ but the constant churn of new processes, shifting priorities, and realignments steadily erodes morale and momentum. It’s the slow burn—the death by a thousand cuts—that kills transformation.

For COOs, leading successful transformation starts with a clear, experience-backed blueprint. They must begin the journey with a well-defined target operating model that anticipates landmines, avoids false starts, and provides a solid foundation to assess the current state, chart the right interventions, and activate a structured execution plan.

Next-gen BPS partners do more than design the vision—they bring it to life. They reimagine the role of technology across the process, with AI, automation, analytics, and data acting as stewards to meet evolving demands. They establish a modern technology environment to support the agility required for rapid change. To unlock last-mile value and enable scaled transformation, these partners create learning loops, run iterative pilots, and drive execution with precision, turning strategy into reality.

Carriers should not underestimate the effort required. Those leveraging next-gen BPS partners that combine planning with hands-on executional support are far better positioned to overcome change fatigue and deliver scalable, adaptable, and sustainable transformation in a world of constant flux.

AI, automation, analytics, and data are reshaping L&A operations across claims, distribution, underwriting, and pricing. In distribution, AI-driven tools guide advisors with next-best product recommendations based on life events, demographics, and behavioral data. In underwriting, data and analytics are reimagining risk evaluation, boosting efficiency, and sharpening decision-making. In pricing, intelligent models fueled by internal and external data generate ex-ante decisions and bindable quotes tailored to each buyer’s risk profile. On the claims side, AI streamlines routing, automates triage, and strengthens risk monitoring and mitigation.

What used to take a month can now be done in 10 minutes. With AI-powered automation, a customer can get a quote, complete underwriting, and finalize the purchase in 15 minutes—without ever speaking to a human.

— Senior operations executive at a major New York-based mutual life insurer

Among front-tier technologies, AI stands out as one of the most powerful. Its focus, however, should go beyond speed and efficiency to include economics and meaningful business impact.

A leading Iowa-based life insurer highlighted early gains:

AI-powered document recognition and indexing that reduced manual effort, self-service tools that minimized advisor dependency on call centers, and automated business rule validation that accelerated decisions and improved processing efficiency.

— Operations head of a leading Iowa-based insurer

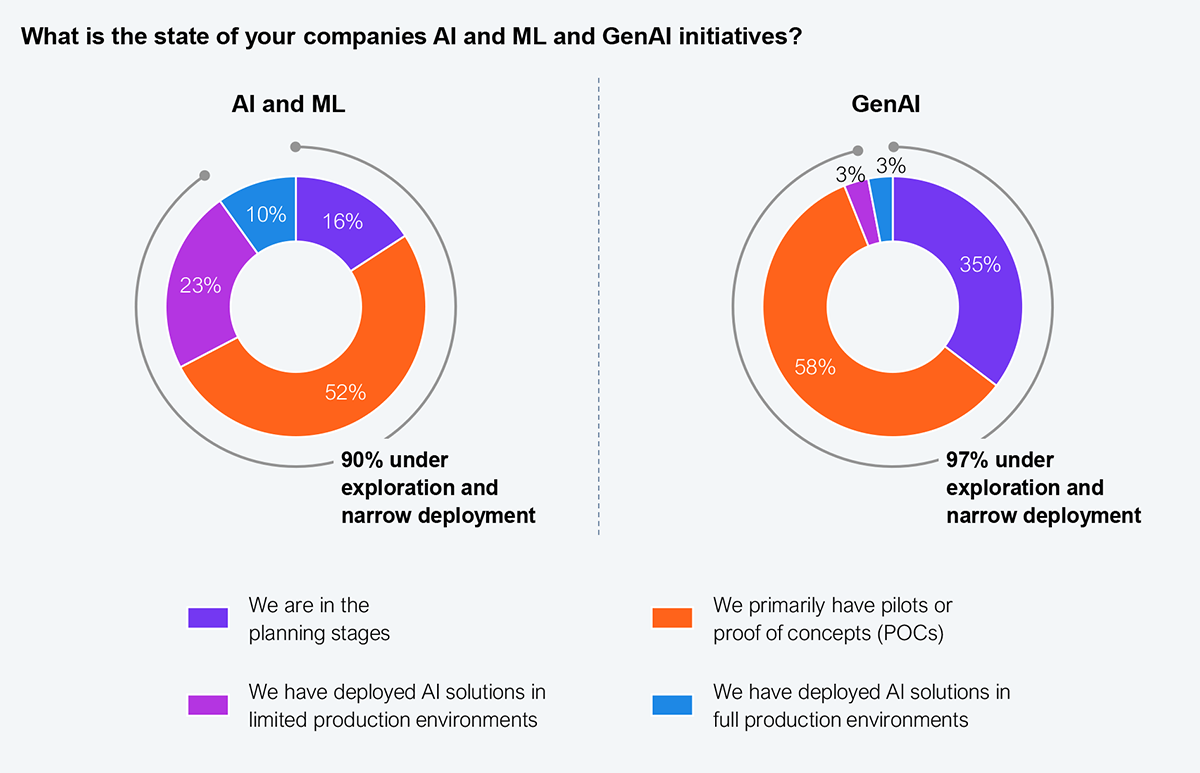

The reality check is that the path to real value through AI is still riddled with challenges. Too many carriers are shopping for tools without a clear strategy. As stated earlier, one of the biggest barriers is a misplaced focus on technology rather than business outcomes. While many carriers have surfaced promising use cases, these often become distractions instead of delivering measurable impact. AI and analytics are starting to reshape operations, but explosive scale remains elusive, as shown in Exhibit 4.

Sample: 31 insurance leaders

Source: HFS Research, 2025

Next-gen BPS can finally move the needle on business value—not just by delivering the right technologies but by bringing a deep understanding of L&A processes and workflows. These partners offer more than tools; they bring operational scaffolding, domain-aligned talent, and integration capability to embed technology where it matters most. This involves modernizing legacy systems, strengthening data foundations, driving cultural and organizational change, and orchestrating GenAI, traditional AI, and intelligent automation into a cohesive, outcome-led operating model.

For COOs, the imperative is clear: it’s time to move from experimentation to execution. The winners won’t be those with the flashiest pilots but those who build the foundations to scale AI with clear business goals, strong operational underpinnings, and an uncompromising focus on outcomes.

As one of the oldest industries, insurance continues to service policies written 50 to 90 years ago—locked in outdated terms while dragging down operations and burdening manual processes. The evolving regulations and fragmented state laws require older claims to be processed manually, navigating a labyrinth of incomplete records and rigid frameworks. Contact center teams are left scrambling, turning routine requests into operational headaches.

Typically, these legacy policy blocks are managed on aging systems that are remarkably stable unless disrupted. Fully rewriting or replacing them remains unrealistic. The smarter path forward is a dual-track strategy: allow the legacy core to handle compliance, record-keeping, and long-tail policies, while greenfield platforms lead the charge on new business and digital innovation. The challenge and opportunity lie in distinguishing what to preserve versus what to reinvent.

A COO of a leading North American L&A provider and a former consultant who helped multiple carriers transform shared a grounded view on building the ‘NewCo’ while keeping the ‘OldCo’:

NewCo is tasked with building the future and driving innovation, while OldCo supports it with funding, maintaining a reasonable return profile. This approach ensures progress without jeopardizing the stability of existing operations.

— COO of a leading North America L&A provider and former transformation consultant

Investing in a greenfield technology is no longer bold; it’s essential. These clean-slate systems offer the scalability, agility, and modular design needed to meet the rising demands for speed, personalization, and seamless customer experiences. API-first architectures ensure interoperability. Smart risk governance keeps customization in check. More critically, greenfield platforms free L&A insurers from the constraints of traditional policies, enabling faster product launches and innovation at scale.

Next-gen BPS providers are the critical enablers of this dual-track future. They bring the operational muscle to run legacy and greenfield blocks in parallel, applying digital playbooks, platform accelerators, and modular tech stacks to streamline execution and reduce transition risk. These partners can alleviate long-term operational drag by managing legacy efficiently while standing up and scaling greenfield platforms or implementing commercial-off-the-shelf (COTS) solutions to support new business lines.

For COOs, the mandate is clear: bridge the old and the new without compromising performance. Ensuring compliance, service continuity, and cost efficiency demands a next-gen BPS partner. Carriers that strike this balance aren’t weighed down by legacy; they’re actively participating in the North American insurance momentum, driving innovation while maintaining operational stability.

L&A insurers face a simple choice: continue to apply band-aids over legacy complexity with tactical fixes or reimagine operations around business outcomes. Enterprise COOs must quickly assess their service provider partnerships across three dimensions: value-to-effort ratio, legacy support vs. innovation enablement, and outcome-tied commercial models.

If your service provider can’t deliver on all three, you’re feeding your own obsolescence because the next-gen BPS model offers more than efficiency. It provides the infrastructure to embed AI and automation into daily operations, navigate dual-speed transformation, and scale customer-centric models without breaking the core.

This isn’t about outsourcing. It’s about rewriting the operational playbook. Strategic BPS partners bring the domain depth, tech integration, and change management muscle that most carriers don’t have in-house. For an industry grappling with $200 billion in operational debt, this is the most straightforward and immediate path to breaking the transformation gridlock.

Enterprise leaders must stop treating BPS as a cost lever and use it as a growth platform. Reevaluate your partnerships, redesign your operating model, and prioritize value over effort. The future of your business depends on it.

Register now for immediate access of HFS' research, data and forward looking trends.

Get StartedIf you don't have an account, Register here |

Register now for immediate access of HFS' research, data and forward looking trends.

Get Started