Today’s CMOs and CDOs face pressure on three fronts: the erosion of traditional digital ad effectiveness as cookies disappear and privacy rules tighten, the fragmentation of media ecosystems across channels, and the relentless demands to prove ROI on every marketing dollar. Retail media networks (RMNs) promise a worthy solution by offering closed-loop distribution, activated via rich first-party media delivery across digital and physical touchpoints.

According to industry estimates, RMNs’ spend will exceed $179 billion by 2025, outpacing TV and rivaling traditional digital media growth. In the US alone, RMNs are expected to approach $60 billion in annual spend this year and hit $100 billion by 2028, growing at roughly 20% year‑over‑year.

Wipro’s VisionEDGE is a credible platform in the RMN space, which can turn stores’ digital signage into a profit engine by linking attention, engagement, and POS data.

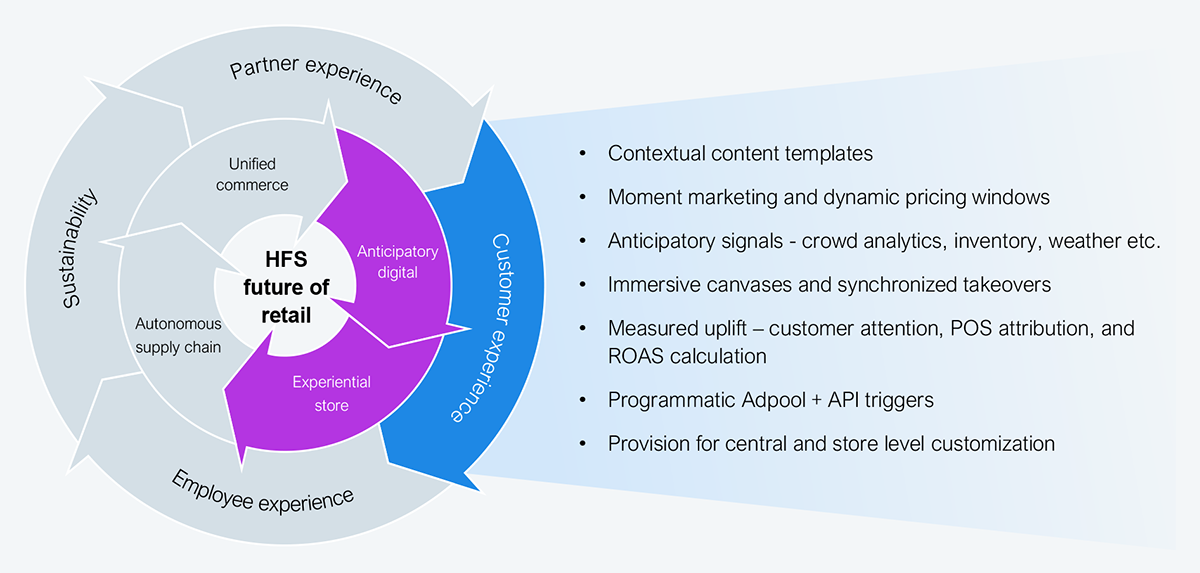

Wipro VisionEDGE aligns well with HFS Retail Framework, encompassing experiential stores, anticipatory retail, and measurable customer experience (see Exhibit 1). The platform works well in stadiums and airports, but the economics shine on the retail fleet scale.

RMN monetization compounds. For example, a nationwide retail chain can reach millions of shoppers across thousands of stores daily, linking ad exposure directly to point-of-sale transactions. That scale multiplies reach and turns every screen into a measurable profit engine.

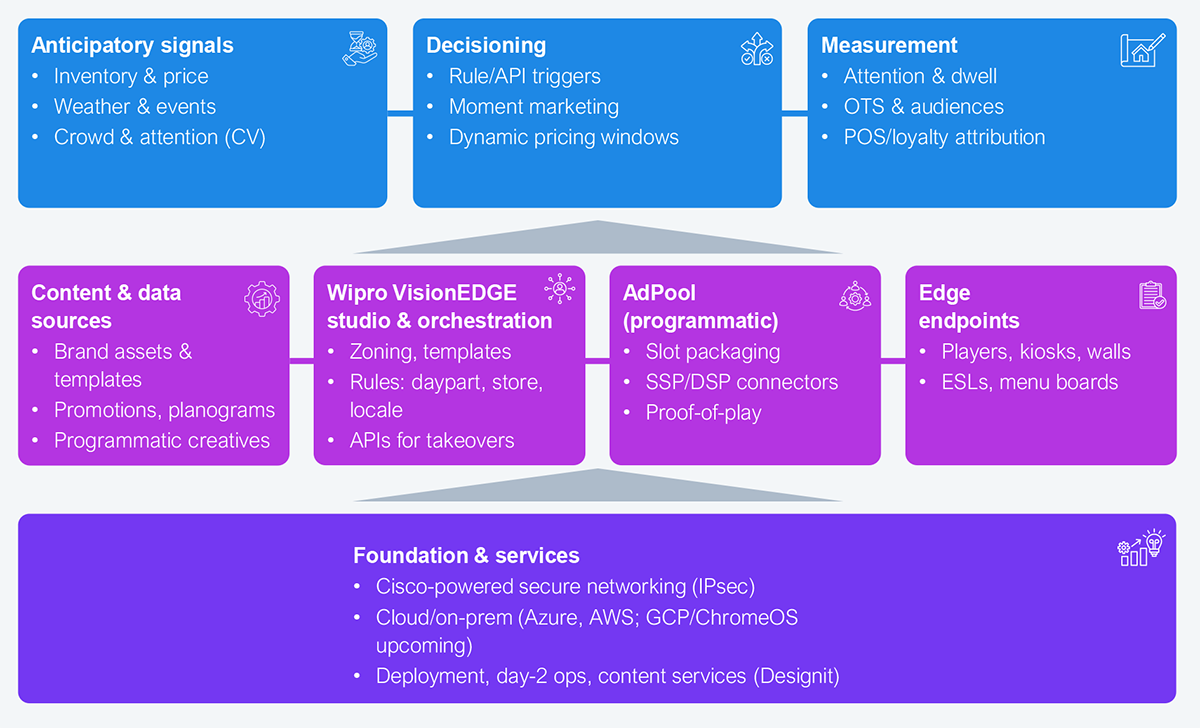

However, the industry is only beginning the journey. Many retail stores lack digital infrastructure, high‑speed networks, and standard screen deployments. Wipro VisionEDGE bridges this gap with a flexible player strategy (supporting cloud/on‑prem), secure IPsec network overlays, and field deployment plus day‑2 ops services. The platform can bring even less digitally mature stores into the RMN fold, accelerating access to what will become a billion‑dollar industry opportunity.

As illustrated in Exhibit 1, Wipro VisionEDGE anchors experiential and anticipatory capabilities in the inner flywheel of the HFS framework. In contrast, the outer flywheel, i.e., higher customer experience, is lifted by transparent measurement and optimization at fleet scale.

Source: HFS Analysis of Wipro’s VisionEDGE

Ditch the static signs: Create an in-store media network that shoppers notice

The platform centralizes control for thousands of endpoints and synchronizes content across mixed screen zones and video walls. Based on the demo given to HFS analysts, the result feels like ‘real media,’ not static signage: synchronized takeovers, interactive kiosks, endless aisles, dynamic menu boards, and electronic shelf labels (ESLs), all mapped to merchandising moments and brand activations. That’s the core of an experiential store.

Move beyond schedules: Let stores react in real time to shopper signals

Anticipatory means the store reacts before the shopper asks. Screens shift from static loops to moment-based marketing, such as sunscreen when the sun comes out, promotions before shelves run dry, or brand takeovers triggered by live events. Wipro’s demo showed how data ingestion, rule sets, and AdPool fills make this real. Device-to-cloud flexibility drives scale, but the true differentiator is attribution and monetization.

RMNs improve shopper journey and engagement

Imagine entering a store and seeing a display promoting a seasonal jacket based on current weather, or receiving loyalty tier offers personalized to your profile as you approach a digital kiosk. Such experiences reduce friction, create relevant moments, and drive incremental basket lift.

Prove screens drive sales, not screen spam

The outer flywheel improves because attention drives ‘engagement,’ which leads to ‘purchase’ that can be measured and tuned. Wipro VisionEDGE combines proof‑of‑play with computer‑vision attention/dwell, then stitches to POS/loyalty for attribution. That closes the loop, reduces ‘screen spam,’ and earns higher CPMs (cost per thousand impressions) and better in‑store outcomes.

HFS analyzed (see Exhibit 2) how Wipro VisionEDGE connects content and monetization to edge playback, finally closing the loop with audience analytics and POS‑linked attribution, all supported by network, cloud deployment, and services.

Source: HFS Analysis of the Wipro VisionEdge

Wipro VisionEDGE is a modular platform that a retailer can buy as software‑plus‑services or as an all-in bundle:

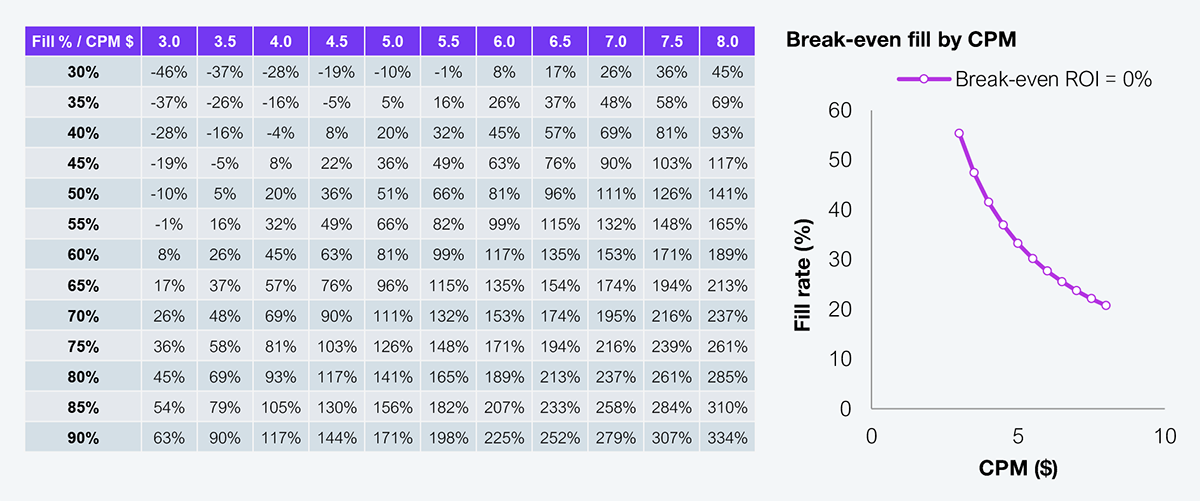

HFS estimates (see Exhibit 3) demonstrate that in-store retail media can be one of the highest-margin businesses a retailer can launch. The economics are clear: break-even hits at just one-third ad fill with CPMs as low as $5. From there, returns rise steeply; at CPM, $6 and 60% fill, and ROI exceeds 117% per store. Every CMO and CFO should run this math against their telemetry: footfall, dwell, reach, and conversion. The line between a loss-making pilot and a scaled profit engine comes down to two levers: how quickly you fill inventory and whether you can prove sales impact. If you do not control those, your competitor will. Amazon Ads continues to dominate with nearly $50 billion in ad revenues, larger than all other US RMNs combined. Walmart Connect is a distant second with $4.4 billion in 2025, up 27% year‑over‑year.

HFS assumptions per store: footfall 900/day, reach 55%, effective ad exposures 10 per reached shopper, annual run-cost $3,000. ROI = (ad revenue − cost) ÷ cost. Revenue = CPM × (impressions ÷ 1,000), impressions/day = footfall × reach × exposures × fill. Replace with retailer telemetry to calibrate.

Source: HFS Research Analysis, 2025

Wipro VisionEDGE has sports venues and airports as clients with proven synchronization, control, and storytelling canvases. For example, successful installations at a leading sports venue and one of the busiest airports in the US have clear metrics to prove revenue maximization and elevated customer experience. If stadiums and airports can monetize attention in real time, imagine the economics of a 2,500-store retail fleet. One of North America’s largest retail-adjacent media networks showcases how synchronized content and real-time analytics can transform screens into revenue engines. The platform’s current retail pipeline includes several multi-thousand store retail opportunities, including one of the largest pharmacy chains in the US where the economics may dwarf other verticals.

Who should be in the room for an effective RMN setup?

Retailers considering in-store RMNs should:

Register now for immediate access of HFS' research, data and forward looking trends.

Get StartedIf you don't have an account, Register here |

Register now for immediate access of HFS' research, data and forward looking trends.

Get Started