AI will have a significant impact on the way professional services are delivered. HFS researched the effect of AI on the delivery of tax and audit services. The research comprised two surveys to understand the implications and impact of AI on professional services conducted in 2024. The first was a qualitative research study among tax and audit professionals and finance executives from Global 2000 enterprises across a cross-section of industries, including healthcare, BFSI, life sciences, and manufacturing. The second was a quantitative study conducted among 1,000 enterprise executives across ten countries in North America, Western Europe, and Asia Pacific.

Tax and audit activities for the enterprise and service providers, especially the Big 4 firms, are crucial to companies’ successful operations, financial compliance, and overall financial market well-being. AI has the potential to significantly disrupt these tax and audit functions. An initial primary driver for AI deployment will be using LLM to access unstructured data for benchmarking, compliance, and regulatory activities for both tax and audit. Often, these activities can make up over half of the effort in an audit, tax engagement, or workstream.

It is interesting to note that changes in audit services may take three years or longer because several AI actions will involve repairing transaction processing inefficiencies, requiring significant change management and process transformation. Also, regulatory and compliance rules for auditing can slow down AI adoption.

The tax function will see changes in how it works with AI deployment in roughly two years. This happens sooner because of the following reasons-

AI will bring a new value equation for enterprises drowning in manual, transactional processes and wrestling with messy data management. The current tax and audit models are on the cusp of a new data and insight-driven delivery model and value proposition. AI is the key to transforming these legacy models, creating an opportunity for radical change. This will soon lead to the rise of new types of assurance services, including AI quality assurance engineering, AI auditors, AI ethics, and compliance specialists.

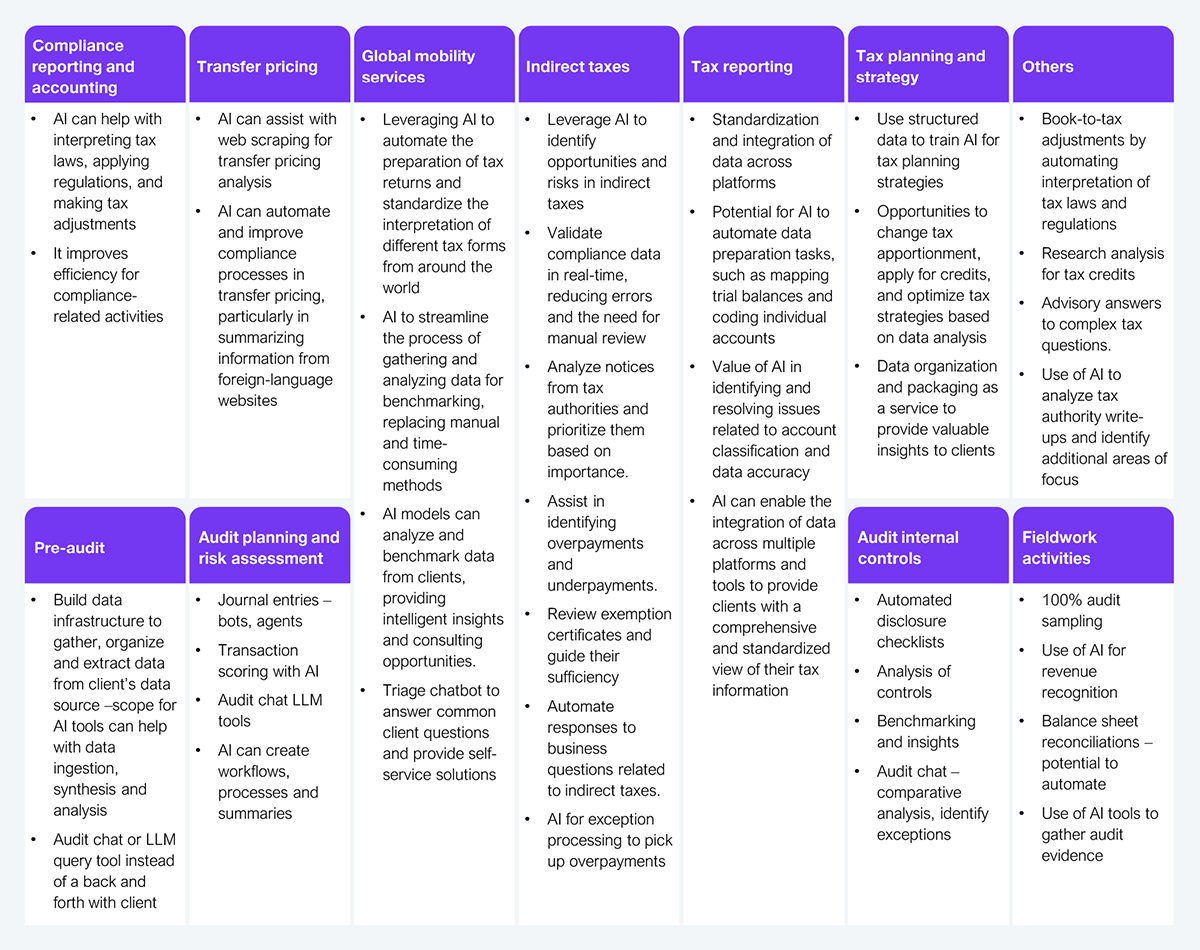

Exhibit 1 below shows some use cases where AI can impact the tax and audit value chain, from compliance and reporting to risk assessment, to planning, and strategy. Additionally, the ability of AI to have such an impact across the entirety of the tax and audit value chain makes it more valuable.

Source: HFS Research, 2025

AI’s transformative impacts on tax and audit include-

These data points underscore that businesses will increasingly rely on data-driven strategies and see AI as a critical tool in optimizing their tax and audit process.

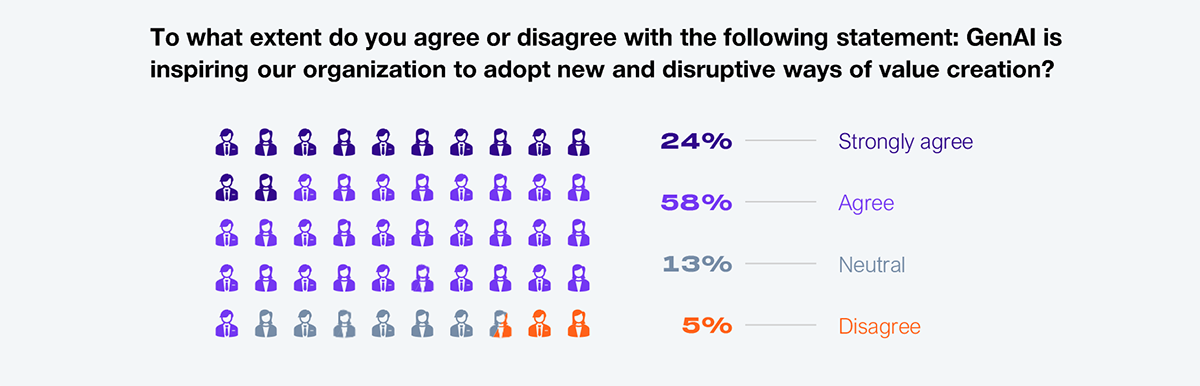

Specifically, the talk of the town, GenAI, also has a high-reaching impact on the finance sector as a whole. In Exhibit 2 below, more than 80% of finance leaders agree on its importance in driving value creation.

Sample: 40 Finance leaders

Source: HFS Research, 2025

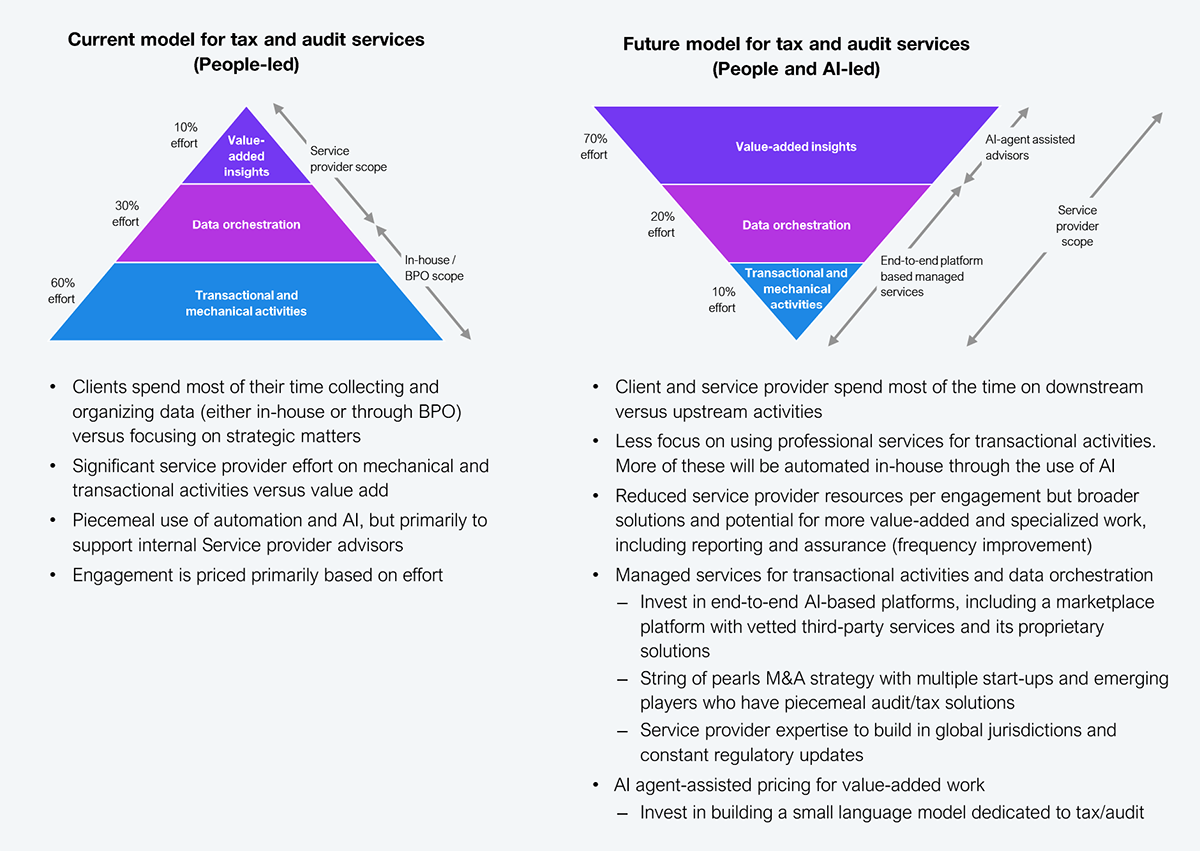

While the traditional model requires clients to spend most of their time collecting and organizing data, in-house or through BPO, the renewed people and AI-led model will enable automated compliance, anomaly detection, and real-time insights. This will allow humans to focus on strategic thinking and high-value services augmented by GenAI agents.

As shown in Exhibit 3 below, AI will transform the long-established people-led model into a people and AI-led model, with value-added insights occupying the most importance and effort instead of transactional and mechanical activities.

Source: HFS Research, 2025

AI can handle the grind of transactional processes, data, and compliance in tax while fueling strategic tax planning and audit innovation. This will be achieved mainly by substituting legacy professional services with AI products, platforms, and solutions specifically for tax and audit, powered by skilled human counterparts.

While most companies are still testing the waters of AI by dipping their toes into use-case analyses and subsequent pilots, they do not have much time to play around with it, as the AI-led model is set to take over within two to three years. Although barriers exist that seek to undermine this change in the form of data quality, regulatory constraints, and legacy systems, we believe that these will be overcome as time progresses and things pick up.

From our study, half (50%) of the respondents anticipate that AI will automate data analysis and insights-related tasks. Thus, early movers will have the chance to quickly transcend from transactional-heavy services to strategic services bolstered by AI. Businesses are likely leveraging AI to not only analyze data faster but also uncover patterns and trends that might be missed by human analysis. We see all this leading to a significant competitive advantage for the early movers in the market.

Service providers need to exceed the market’s expectations. They must focus on developing new products and platforms that wrap around their service delivery, with AI as the focal point. Cost is another issue that can be a differentiating factor for enterprises when choosing a service provider to drive their AI initiatives and replace their legacy systems with new AI-driven solutions.

As AI technologies evolve and grow in complexity, organizations will need more efficiently sourced specialized skills. This is where service providers will come in handy with their skilled resources and technical expertise. Additionally, the providers would witness new job creation as new business models with an essential AI component become commonplace.

AI is flipping the tax and audit world on its head. While it will take three or more years to see these changes become widespread, enterprises will start to immediately see the impact of AI on specific parts of the tax and audit value chain. For companies that use AI wisely, it will be an enabler and not a disruptor in terms of replacing human employees. On the contrary, from all our research, the message is that it will create new roles, generate greater insight and reporting transparency, and drive a new level of human productivity.

Register now for immediate access of HFS' research, data and forward looking trends.

Get StartedIf you don't have an account, Register here |

Register now for immediate access of HFS' research, data and forward looking trends.

Get Started